Oversupply equilibrium

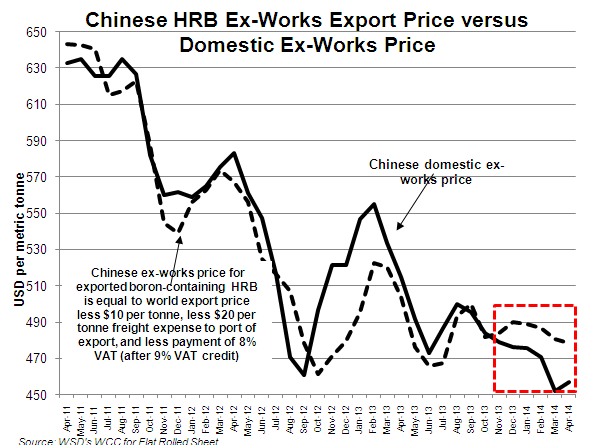

Based on its monthly World Cost Curve data since 2011, WSD has observed that the hot-rolled band export price, after taking into account the cost to deliver the steel to the port of export and, in China's case, adding an eight percent value-added tax for boron-containing steel, matches up as follows:

- For the median-cost non-Chinese mill, with its operating cost.

- For the median-cost Chinese mill, with its marginal cost (when also assuming that its HRB export price realization is $10/mt less than for the non-Chinese steel mills).

We've also compared, as indicated in the accompanying graphic, the Chinese mills' domestic ex-works price against the export price (as defined above). We see that, from January 2011 until late 2013, the home price was always not far from, and/or above, the export price. However, since late 2013, the gap in favor of the export price has widened to about $20-25/mt.

The higher price when exporting since late 2013, along with sizable overcapacity, helps to explain the Chinese steel mills' determination to boost export bookings. For the first four months of 2014, the Chinese mills' exports of all steel products amount to 25.9 million mt versus 20 million mt in the first four months of 2013.

For additional information of WSD's services, please contact us at:

wsd@worldsteeldynamics.com

Or visit our website at:

www.worldsteeldynamics.com