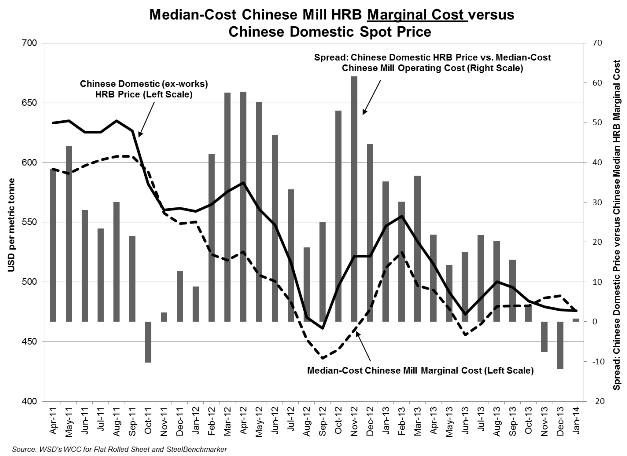

Key question #1: Why has China’s ex-works HRB price settled in at the marginal cost of the median-cost Chinese mill?

Here are the reasons:

• In China, the number of mills producing wide hot-rolled band, at about 88 (as noted earlier), far exceeds the number in any other market. In Japan, for example, there are about 20 hot strip mills, of which around 12 are owned by the two largest companies (Nippon Steel Sumitomo Metal and JFE, each of which is the result of a merger with a large competitor).

• Steel production in China is “sticky” on the downside – i.e., resistant to reduction. Production tends to be sustained if orders are received, no matter what the price, because: a) the mills have a less direct profit motive; and b) the local municipality that owns a share of the mill demands that production be sustained. (Note: The local municipality typically appoints the steel company’s top executives.) The municipality receives about 25 percent of the 17 percent value added tax that’s collected when a steel product is sold.

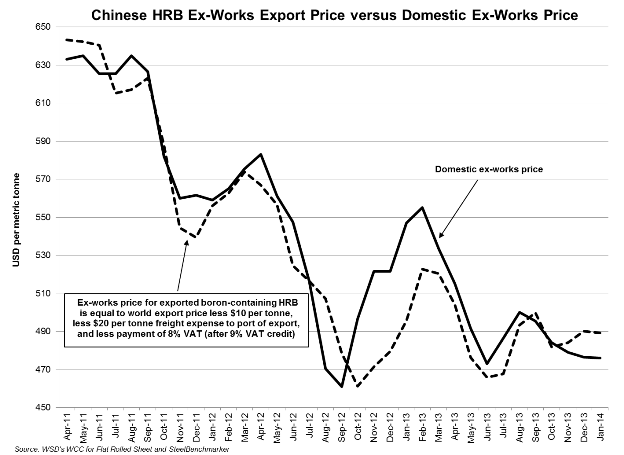

On domestic sales, the steel mill does not pay a value added tax because it collects the full 17 percent tax when it sells its product – and, then, it rebates to the government the VAT revenues it’s received over and above the VAT taxes it’s paid. However, on exports, unless there’s a rebate, such as the 9 percent credit on boron-added steels, the mill pays the full 17 percent value added tax; but, in this case, there’s no customer reimbursement since the mill is already charging what the market will bear.

Key question #2: Why are pricing “death spirals” short outside of China and long in China?

Outside of China, a HRB pricing “death spiral” rarely lasts two months. It occurs when the steel mills’ new orders are so low, in part because their customers are seeking to liquidate inventory, that the mill inadvertently builds excess inventory. The inventory must be liquidated because “cash is king.” The marketplace is gripped by a “chill” as steel buyers “sit on their hands” – i.e., refrain from placing orders – because they fear prices are declining.

However, once the price declines to, or below, the marginal cost of many of the mills, two corrective developments occur almost simultaneously: First, the mills engage in significant production cutbacks; and, second, the mills’ order entry rises as steel buyers, who realize the price has fallen to unsustainably low levels, boost their orders.

In China’s case, a “death spiral” condition may be sustained for a year or more because the mills don’t cut back production as long as they have orders on hand no matter what the price.

Key question #3: How long will it take before “death spiral” pricing conditions in China change the “behavior pattern” of that country’s medium-sized and larger steel mills?

It may take two years of “death spiral” pricing before there’s a huge cutback in the steel mills’ capital outlays – i.e., not until 2015. Financial pressures at present are mounting in part because more mills have leveraged balance sheets than a few years ago. Capital outlays are not yet down sharply because the medium-sized and larger steel mills can make up their cash shortfall by borrowing from government-owned banks. However, the current condition may not be sustainable because: a) more municipalities are facing huge debt repayment problems; and b) the interest rate on funds borrowed from the state banks is expected to rise.

Capital spending by China’s steel mills, which amounted to $80 billion in 2012 and about $84 billion in 2013, may fall to about $70 billion in 2014. By 2016-2017, we forecast it will drop to $30-45 billion per year. Interestingly, if steel industry capital outlays drop by $40 billion per annum, this development alone might reduce the steel consumed in the construction of steel plants by 15 million metric tons.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved