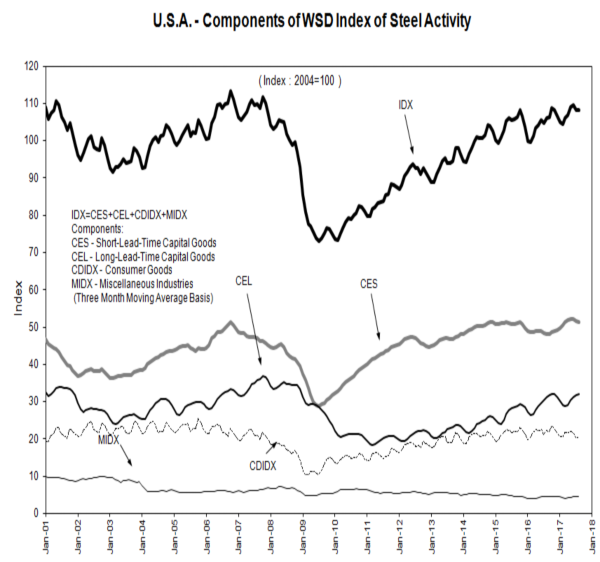

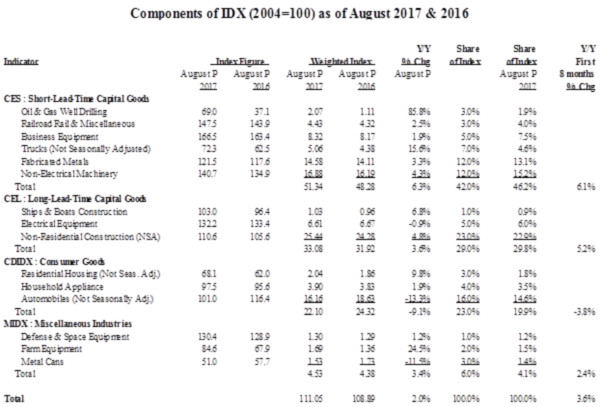

After rising 3.9% in 2015, but only 0.7% in 2016, WSD’s IDX is up an average of 3.6% for the first eight months of 2017. This rise is composed of a 6.1% increase for the capital equipment short-lead-time (CES) component of the overall index; a 5.4% rise for the capital equipment long-lead time (CEL) component; and, a 3.7% drop in the consumer goods component (CDIDX) component.

Looking ahead the next few years, a surge in capital spending in the United States (perhaps reflecting a sizable investment credit on capital outlays by businesses) seems to be essential if USA steel demand is to rise significantly given the following: a) many USA municipalities have high debt and sizable entitlement obligations for retiree pension and medical costs – both of which limit their ability to engage in the financing of sizable infrastructure projects; b) there’s been about a 50% decline in USA retail commercial construction as internet shopping takes away market share from malls shopping; c) surging oil and gas drilling, that has significantly driven up steel demand, may now be approaching a peak; d) USA automotive output may also be close to peak; and e) Publicly funded non-residential construction has recently fallen to a 10-year low.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright Ó 2017 by World Steel Dynamics Inc. all rights reserved