Wild swings in the price spread

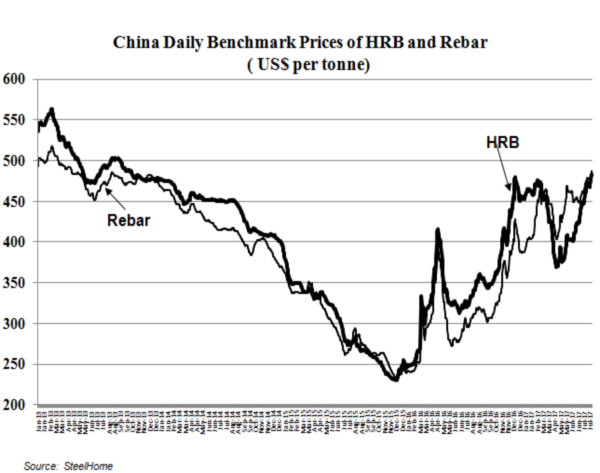

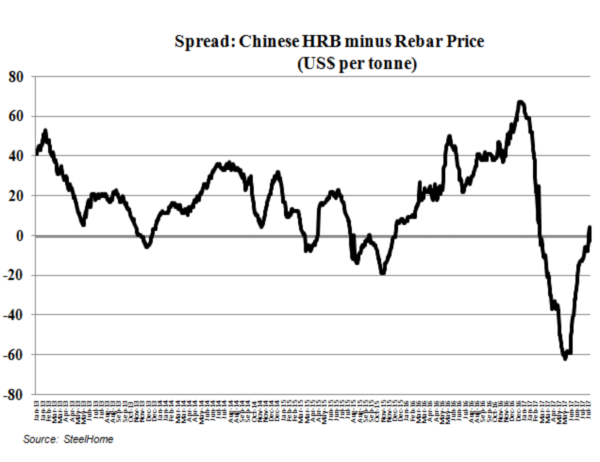

As indicated in the accompanying exhibits, the Chinese ex-works domestic price of hot-rolled band has often sold roughly about $15 per tonne above the price of rebar. This price premium reflected the higher cost to produce hot-rolled band and the continuing oversupply of rebar in the country due to the hundreds of small-sized integrated producers with the capability to ramp up output once the price more than covered their marginal cost.

However, this traditional pricing relationship has turned topsy-turvy this year. In early 2017, hot-rolled band, ex-works, rose briefly to a price premium of $67 per tonne versus rebar. Then, by May, the hot-rolled band price sold at a discount of $62 per tonne to the rebar price – for a swing in the spread this year of $129 per tonne.

There have been several key events:

- The Chinese government mandated in January 2017 the closure by June 30, 2017 of the country’s clandestine induction furnace (IF) steelmakers. These IF companies were not reporting the 30 to 50+ million tonnes per year of low quality billet they were producing. (Note: The IF billet is low quality because the induction steelmaking furnace, when melting the scrap to liquid steel, has no means by which to remove the phosphorus from the steel.). Hence, with IF production being eliminated and steel demand surging – consistent with the government’s vigorous efforts to promote gains in infrastructure spending – a shortage of rebar developed.

- Concurrently, a glut of steel scrap developed because this was the raw material used by induction furnace steelmakers when making steel. As well, the Chinese domestic integrated mills that account for about 92% of the country’s steel output, were using less than 10% steel scrap in the metallics charge to their BOF steelmaking furnaces. Hence, even though the country’s integrated steelmaking were just beginning to use more steel scrap in their BOF steelmaking furnaces, China’s steel scrap prices were so low that, despite the 40% export duty, scrap exports began to rise.

- As of early August 2017, with the price of hot-rolled band up sharply reflecting strong demand at home and on the export market, the prices of hot-rolled band and rebar were about the same.

It’s noteworthy that global hot-rolled band prices and steelmakers’ raw material prices have been rising this summer, when it’s normally the time of year that steel prices are in the doldrums.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright Ó 2017 by World Steel Dynamics Inc. all rights reserved