About two years ago, WSD introduced the concept of ECO-Capacity, with it being defined as the level of global steel production, in a rising global steel production environment, at which the mills’ hot-rolled band marginal cost starts to rise (as fixed costs, often at less than 15% of total operating costs, have declined due to the benefits of higher volume).

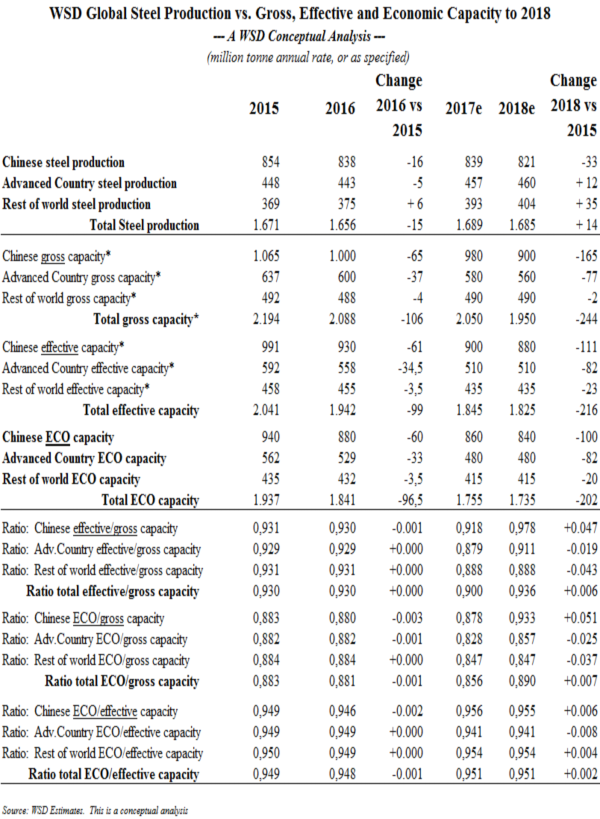

As indicated in the accompanying exhibit, WSD breaks down its capacity figures into three categories: Gross capacity, effective capacity and ECO-Capacity. For each, we have estimates for China, the Advanced Countries and the Rest of the Developing World (excluding China). We consider the aggregated global figures the most indicative when it comes to possible steel export product price changes, and steelmakers’ major raw material price changes, because they all reside in the same global bathtub.

- Gross capacity is the theoretical maximum capacity level assuming no bottlenecks. It might also be called engineered capacity. For the global steel industry in 2017, this figure is estimated at 2.05 billion tonnes.

- Effective capacity is estimated to be the level of steel production that’s achieved six to twelve months after a steel shortage develops on the world market. Our analysis of effective versus gross capacity, which has been ongoing since 1975, with the publishing of WSD’s first report, World Steel Supply Dynamics: 1975-1990, indicates that the ratio of effective to gross capacity is about 0.90. Hence, for 2017, granted that gross capacity is 2.05 billion tonnes, effective capacity would be about 1.845 billion tonnes.

- ECO-Capacity – that can also be considered to be “economic” or “ecological” capacity – is assumed to be equal to 95% of effective capacity. Hence, given the figure for 2017 for effective capacity, ECO-Capacity is estimated at 1.755 billion tonnes.

Global steel production from 2013 to 2016 ranged from a low of 1.65 billion tonnes (in 2016) to a high of 1.71 billion tonnes in 2014.

However, from early 2017 to August 2017, global steel production climbed to a seasonally-adjusted annual rate of 1.65 billion tonnes to 1.76 billion tonnes (a record figure). On this basis, the ECO-Capacity operating rate was close to 100%.

(Note: WSD’s capacity analysis is highly conceptual in nature. Hence, our view of ECO-Capacity is more likely reflecting reality when global steel production has been stagnant for a number of years. As a result of this stagnation, many global mills will have reduced their ready-to-operate capacity and altered purchasing arrangements with suppliers.)

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright Ó 2017 by World Steel Dynamics Inc. all rights reserved