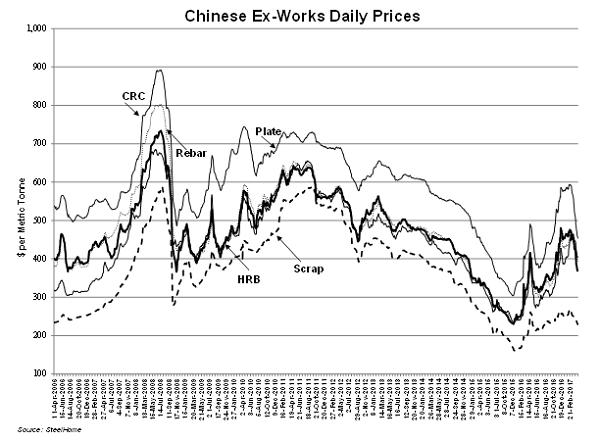

China’s ex-works prices are “all over the lot.” These prices are impacted by supply/demand factors, steel industry sentiment and futures prices. There are many day-traders in China, further adding to volatility. When the futures price is rising, this may pull up the mills’ ex-works prices; and, the opposite occurs when the futures prices are falling. Here’s what happened to the prices for five products since mid-February 2017 – as of April 24, 2017.

• Hot-rolled band: The price is down $106 per tonne to $370 per tonne from $476 per tonne (February 17), a 22% decline.

• Cold-rolled coil: The price fell $118 per tonne to $454 per tonne from $594 per tonne (February 23), a decline of 24%. The spread between cold-rolled coil and hot-rolled band narrowed to $84 per tonne from $118 per tonne. Why the lessened spread? One answer could be diminished demand for cold-rolled coil relative to hot-rolled band. However, WSD thinks the most likely reason is the massive overproduction of hot-rolled band –up 10 to 15% on a year-to-year basis – that’s inundated the cold-rolling mills with so much HRB supply that the production of cold-rolled coil became excessive.

• Discrete plate: The price fell just $59per tonne to $393 per tonne from $452 per tonne (February 17), a drop of 13%. Because the product is produced almost exclusively by integrated steelmakers and the outlook for shipbuilding activity is diminished, perhaps the product is prone to less speculative influence.

• Rebar: The price fell $59 per tonne to $406 per tonne from $465 per tonne (February 17), which was a decline of 13%. Hence, the cessation of billet production by induction furnace steelmakers has helped to better sustain this price than is the case for hot-rolled band and cold-rolled coil.

• Steel scrap: The Chinese price fell only $25 per tonne to $229 per tonne from $254 per tonne, for a drop of 10%. Perhaps the relatively high price on the world market helped to sustain the Chinese price even though the country’s export duty is 40%. In mid-April 2017, shredded steel scrap in the United States was about $295 per tonne.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2017 by World Steel Dynamics Inc. all rights reserved