Part 2. Guess who's holding the trump cards?

Note: Zugzwang is a condition in which a chess player has a solid position; but, once he or she makes the next move, the consequence is a lost position.)

Mercantilism works. It was highly successful for the British in the 1800s, the USA in the early 1900s, the Japanese after World War II until the 1985 Plaza Accord, discussed later, and China since the 1990s.

Mercantilism and protectionism are joined at the hip. Currently, the world seems to be drifting, perhaps rapidly because of the heavy tide, towards protectionism. One reason is slow global growth, which means that job creation is not sizable to begin with. The second reason, to make matters even worse, is that machines are now replacing workers the world over to an alarming extent. An economy may need to grow 2-3% on a GDP basis just to sustain manufacturing employment in the country. Since 1995, manufacturing employment in the United States is down to 12 million from 15 million; yet, current dollar GDP is up 2.5 times.

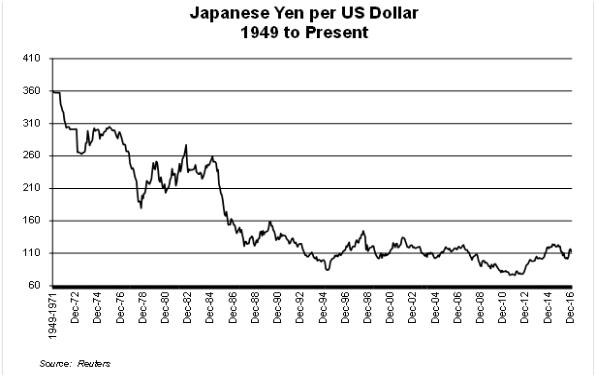

WSD sees strong parallels between the Japanese currency and trade balance situation in the mid-1980s and the current Chinese situation. In 1985 and earlier years, Japan was enjoying a massive trade surplus in manufactured goods with the United States and other Developed Countries. And, because it was pegged - some say manipulated - the Japanese yen had been fairly flat versus the U.S. dollar for more than a decade, which angered the policymakers in the Advanced World because their countries were suffering an ever-widening trade deficit with Japan. The Advanced Countries' solution, which was unfavorable for the Japanese, was worked out in the "Plaza Accord." During a meeting at the Plaza Hotel in New York on September 22, 1985, the governments of France, West Germany, the United States and the United Kingdom threatened the Japanese with sanctions unless they agreed to strengthen their currency. The Japanese acquiesced and, within six months their currency had strengthened substantially. By 1990, Japan's GDP growth had fallen back to about 2% per annum from 4% per annum, or more, for the most of the prior 20 years. The Japanese "party" was over.

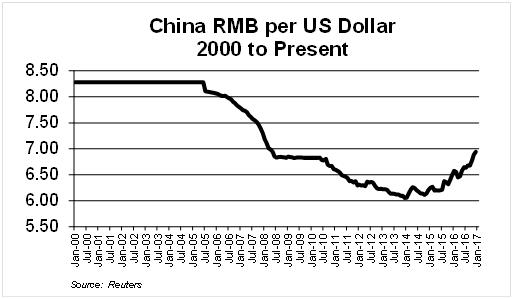

Regarding the Chinese situation at present, Chinese exports to the USA in 2016 were about $450 billion with the USA's exports to China at about $120 billion. Hence, if President Trump is successful in imposing import controls/tariffs on selected Chinese good, he holds the trump card because the massive net trade balances in China's favor.

Here are some challenges Chinese economic policymakers are facing at the present time:

1. A possible further sizable deterioration in the value of the RMB versus the U.S. dollar because its exports of manufacturing goods are lagging. As well, its perceived that its manufacturers have lost much of their international competitive advantage because of: a) sharply rising labor costs; and b) the advance of technology that permits new factories to be built around the world requiring very few man-hours to make the product. Chinese workers' wages rose 10-15% per year from 2000 to 2015 - although, the direct take-home wage increase in 2016 may drop to only about 5%.

2. A major flight of capital from China, with the net amount at $300 billion in 2016 when considering the country's currency reserves. Might the net capital outflow rise to $50 billion monthly especially now that interest rates are rising in the United States and USA treasury securities are considered by many to be the best "safe haven"? China's current currency reserves in December 2016 were about $3.0 trillion versus $3.3 trillion 12 months earlier.

3. The sizable rise in workers' "social benefits" in the years ahead. While the pace of direct wage increases is slowing, the cost for Chinese worker health care and retirement benefits is surging. Social costs may now amount to about 25-30% of a worker's annual employment cost. Even granted that the direct wage increases slow to 5% per annum from 2016 to 2025, the non-wage social benefits may rise by 15% per annum. Hence, by 2025 social benefits may rise to 51% of the workers' total compensation - with the combined pace of wage and social benefit increases at 8.9% per annum in the next decade.

4. The Chinese have become an "international scapegoat." Almost no matter what the problem (this is an exaggeration), the Chinese are now being blamed for it. Chinese bashing helps non-Chinese CEOs the world over to divert attention from real problems; and, it aids politicians searching for votes. (Note: A scapegoat is a person or group that's made to bear blame for others. It takes on the sins of others; and, if often unfairly blamed for problems.)

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2017 by World Steel Dynamics Inc. all rights reserved