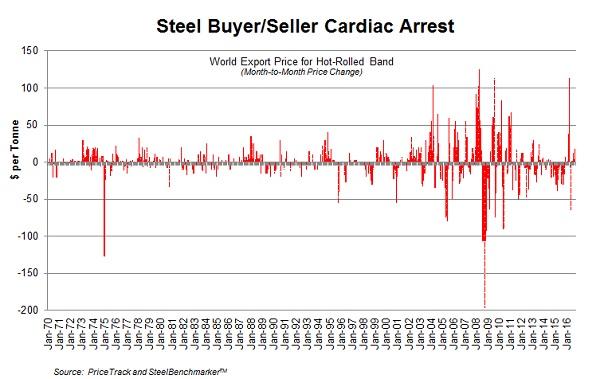

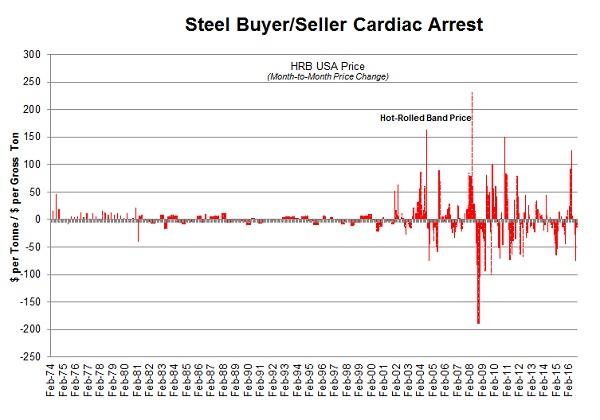

As indicated in the two accompanying graphics, which compare the month-to-month changes of hot-rolled band prices on the world market and in the United States, the inherent price volatility in the system has risen exponentially, especially since 2002, when rising Chinese steel production began to “change the game” for international steelmakers. The “cardiac arrest” condition also applies to the prices of steelmakers’ metallics (iron ore, pig iron, steel scrap and steel scrap substitutes) and coking coal.

The recent $100+ per tonne rise in the price of coking coal, FOB Australia - with the Japanese steel mills paying $200 per tonne for the fourth quarter of 2016 - will add to the factors promoting near-term steel price volatility. Interestingly, perhaps the last thing that’s driving prices on a near-term basis is changes in global steel demand. Huge swings in steel market psychology – with the marketplace being psychological warfare between buyers and sellers – are driven by fear and greed.

What’s the solution for those who must buy and sell these products? First, learn to take advantage of these swings before and/or just when they are starting to happen. Second, look forward to the day when liquid steel futures curves permit all players to hedge the steel price risk.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2016 by World Steel Dynamics Inc. all rights reserved