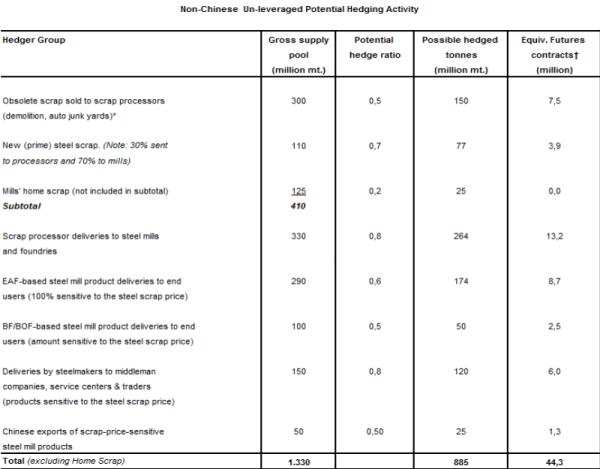

† NASDAQ OMX US Shredded Futures are 20 gt/contract

* It takes about 1.1 tonne of unprocessed obsolete scrap to produce 1.0 tonne of processed scrap.

Non-China obsolete and new scrap consumption in 2014, excluding home scrap, was about 410 million tonnes (equal to 20 million shredded steel scrap futures contracts). LME non-ferrous metals futures trading in 2014 equaled the following multiples of physical consumption: 26X (Tin), 30X(Lead), 34X (Aluminum), 50X (Copper), and 58X (Nickel).

If the steel scrap futures realizes a 15X multiple of steel scrap consumption excluding home scrap, this is equal to 6.15 billion gross tons, or 308 million futures contracts.

(Note: Because steel scrap's path from origination to finished steel product has more stages than the LME non-ferrous metals, its potential "hedgible pool" is significantly larger than the amount of steel scrap consumed by the mills. For example, a junked-car sits in a junk yard where its parts and non-ferrous metal are stripped. The car may sit in inventory for three months before it is bought by a steel scrap processor to be shredded. The mill buys the shredded and makes finished steel products. If it's rebar, the rebar is then sold to a fabricator, that in turn sells the fabricated rebar to a builder. Since the price of the rebar is often directly tied to the price of obsolete and shredded steel scrap, the steel scrap futures curve can provide an effective tool for both sides of the transaction.)

WSD believes that, in a few years, there will be liquid forward curves for steel scrap on futures exchanges reflecting the need to hedge the steel and/or the steel scrap price risk. As an additional benefit, once the steel and/or steel scrap can be hedged effectively, inventory loans from the banks will be much more forthcoming.

The consumption of home, old and new steel scrap in 2014, outside of China, amounted to 495 million tonnes according to WSD’s Global Metallics Balances System for 44 countries – that covers the entire world. However, the scrap price directly impacts 1.33 billion tonnes of transactions, when including the tonnage sold by: a) scrap gatherers/peddlers to scrap processors; b) the processors to the steel mills after taking yield loss into account; and c) the steel mills in the form of finished steel products to their customers for which the spot price of the product is pegged to the price of the steel scrap.

Next, if we make an estimate of the proportion of the scrap and/or steel producers’ product that might be sought to be hedged on a steel scrap futures exchange, the figure drops to 855 million tonnes.

Given that steel scrap is a true global commodity, WSD believes that trading in various grades of this product and/or products tied to it outside of China, could rise to a 20 X multiple of 855 million tonnes. This amounts to 17 billion tonnes of futures trading in steel scrap. On a 20 gross tons per contract basis, this is about 850 million contracts.

It’s a new world out there, folks. Get ready.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2015 by World Steel Dynamics Inc. all rights reserved