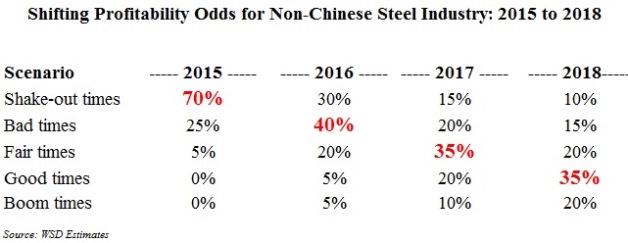

WSD is now extending to 2018 our forecast for the non-Chinese steel industry’s profitability environment for hot-rolled band. As indicated:

• 2015 will probably continue to be a shake-out year, including pricing “death spiral” conditions, because of low priced offerings on the world market by mills in a number of countries and declining steel production (which will be working to drive down the international prices of steel scrap and iron ore).

• 2016 is an improvement, not because underlying steel demand is much better, but because the mills cannot in many cases continue to offer hot-rolled band at a price below their margin cost. Hence, with operating costs down due to lower prices for steelmakers’ raw materials and some price recovery, the industry makes the transition to the “Bad Times” from the “Shake-Out Times” environment. However, profits, and/or the lack thereof, are so low that the industry remains in an “M&A frenzy” and accelerated rationalizations and closedowns of steel plants.

• 2017 is a year in which steel mills improve to the “Fair Times” to “Good Times” industry environment due to the combination of: a) somewhat lessened export deliveries from China for a variety of reasons include trade case restraints; b) somewhat reduced ECO-Capacity; and c) a good pick-up of fixed asset investment outside of China – all of which conspire to push the non-Chinese ECO-Operating rate into the 90s.

• 2018 has the potential to be a “Good Times” to “Boom Times” environment for the steel mills, including perhaps a steel shortage, as steel demand turns up even more strongly. Of course, this assumes that there are no further macro-economic events in the intervening years, including financial crises that zap the global economy. We assume that the financial contagion worry in a number of countries will have eased back significantly by 2018, which is a positive for fixed asset investment growth even if interest rates are somewhat higher.

WSD has been putting forth versions of these themes since November 2014, as is indicated by the titles of our “Early Warnings System” reports since then:

• November 2014, Inside Track #136 – Triple threat: Contagion, Chinese oversupply and the world HRB export price. Global steel production probably headed down in 2015.

• December 2014, Inside Track #137 – The Chinese Steel Armada, Massive – Unconventional – Indefatigable.

• February 2015, Inside Track #138 – Dive! Dive! Dive! Death spiral alert. Steel industry being pinged by enemy warships.

• March 2015, Truth & Consequences #74 – The Truth: Bottom fishing can be productive during pricing death spirals. Consequences: Steel buyers should bait their hooks and catch the limit.

• April 2015, Inside Track #139 – Shake-out conditions persisting. Countervailing forces by 2017 to work to the advantage of many steel mills.

• May 2015, Inside Track #140 – Steel industry 2015 outlook not improving. Chaos and opportunity.

• June 2015, SSS XXX Presentation – Just the Beginning. Controversial Realities, Breakthrough Ideas.

• July 2015, Inside Track #141 – HRB export pricing “death spiral” may last another six months. Chinese export armada in full swing.