Steelmakers’ cost to produce hot-rolled band will continue to swing sharply over the steel cycle. However, in the next five years from the mid-point of one cycle to the next, WSD expects little to no steel mill cost inflation.

The mills’ HRB operating cost to produce hot-rolled band in the past 10 years has swung wildly – it’s been a cost rollercoaster. Based on WSD’s monthly World Cost Curve results for the median-cost Chinese steel mill, the operating cost has ranged from a high of $664 per tonne in September 2011 to a low of $353 per tonne in January 2016 – for a variation of $311 per tonne. For the median-cost non-Chinese mill, the high cost figure was $710 per tonne in July 2011 and the low was $367 per tonne in February2016 – for a variation of $353 per tonne.

Looking ahead to 2025, rather than no change in costs, some decline would also be no surprise.

- A sizable number of higher cost plants will be either eliminated or downsized – especially during periods of shake-out in the industry such as the current one. Multi-plant companies, which are probably growing in number due to heightened M&A activity, will consolidate output at their most efficient units. In China, plant rationalization and company consolidation will be a major event. Its Baowu, already the world’s largest steelmaker, is seeking to double its size to about 200 million tonnes per year largely by acquisition. If iron ore prices remain high relative to steel scrap prices, more integrated steel plants will be shut down due to lack of cost competitiveness. Capital spending needs at integrated plants are especially huge. For example, the relining of a blast furnace may cost more than $75 million and the replacement of aging coke ovens could cost $300+ million.

- Labor costs per tonne will rise only marginally. Man hours per tonne shipped by 2025 may be 5% lower given new labor-saving technologies. The rise in the worker wages may be just moderate because steelworkers, along with those in other manufacturing industries, are losing their negotiating power. As capital replaces labor (Karl Marx is turning over in his grave), workers are becoming increasingly replaceable and fungible.

- Iron ore prices delivered to China may drop significantly. For example, they are currently lofty relative to the world’s leading iron ore producers’ sinter feed cost delivered to the port of export – only about $16 per tonne. More iron ore supply is coming into production in Australia, India, Russia and even Iran. Also, if the steel scrap price is as low as expected, a larger amount of it will be charged into BOF steelmaking furnaces (as an alternative to higher cost liquid pig iron). Chinese pig iron and steel production will be lower in a few years reflecting reduced demand in the country. (Note: If the international iron ore price drops sharply, China’s domestic production of sinter feed and pellet, which is high cost, could fall 50% to roughly 125 million tonnes per year.)

- Coking coal May 2020 was selling for only about $112 per tonne, FOB Australia; hence, there’s far less room for it to drop in price than iron ore. The price is at a level at which a number of non-Australian export-oriented coking coal mines can’t long survive. A “wild card” that could tighten the supply/demand balance for this product would be further mandated closures in China of dangerous coal mines – due to their great depth and the emission of combustible gases. Also, highly polluting privately-owned coke ovens in Shanxi Province may be further cut back.

- The price of obsolete steel scrap is forecast to be lower over the steel cycle in the next decade despite the rising global share of EAF steel production. In China, the obsolete steel scrap reservoir, that’s on average 10-40 years old, is forecast to rise to 318 million tonnes by 2030 versus 124 million tonnes in 2019 – really quite unbelievable, but true. Growing directly reduced iron (DRI) capacity and increased pig iron offerings on the world market at times will exert downside pressures on steel scrap prices.

- Expenses to meet additional air and water pollution mandates through 2025, and perhaps to 2030, may not rise significantly for those plants already meeting the mandated standards. However, beyond 2030, a number of steel mills will begin to take actions to achieve zero carbon emissions by 2050. (Note: Integrated steel plants emit about two tonnes of CO2 per tonne of steel production, versus about 0.5 tonnes for EAF-based units. For most integrated plants, the achievement of zero carbon emissions would entail huge capital outlays in order to re-orient the plant’s steelmaking processes – to the HBI-EAF route rather than the BF/BOF route. Also, a separate facility to produce hydrogen might be needed. Besides the capital costs, the rise in operating cost could be $50-100 per tonne.)

- The purchase price of energy in different forms, including electricity and fuel oil, may be reduced. Because of oversupply, the Brent oil price may not recover to $50 per barrel versus the May 2020 figure of $25 per barrel. The average price in 2019 was $64 per barrel.

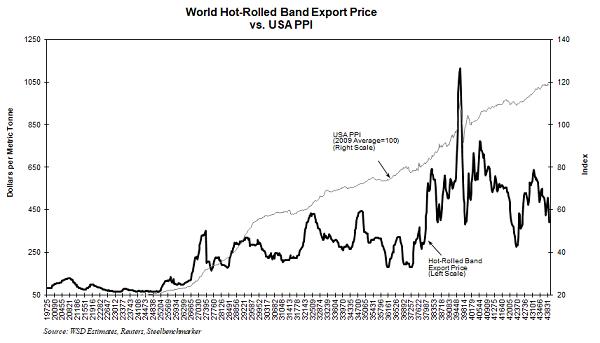

As we see in the accompanying graphic, the export price for hot-rolled band has risen far less than the USA’s producer price index (PPI). Since its peak in 1989, the HRB export price is about unchanged, while the PPI is up about one-third.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2020 by World Steel Dynamics Inc. all rights reserved