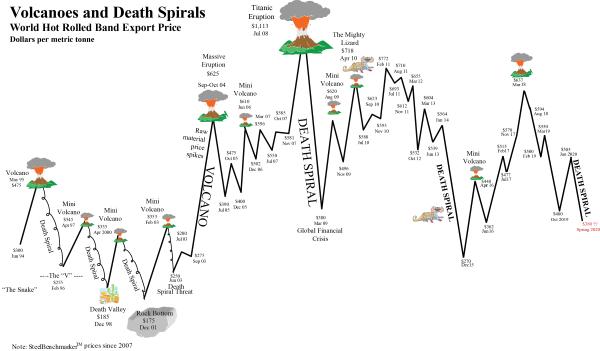

Everyone in the steel business is well aware that steel production in 2020 could decline 10% and that steel export prices may drop to “death spiral” levels – i.e., to, or below, the marginal cost of the median-cost steel mill. Yet, there are some countervailing forces to be considered:

- Severe downturns usually set the stage for longer recoveries. For example, after the financial crisis in the fourth quarter of 2008 – initiated by the Lehman Bros. bankruptcy on September 15, 2008 – the global economy started to recover about mid-2009 with the expansion lasting through 2019. We expect another long recovery when the coronavirus-industry global recession ends. As was the case in 2008 and 2009, a number of excesses in the system, some not detected, are being purged by the power of the “invisible hand”– i.e., price allocates resource.

- Low interest and inflation rates are probably here to stay – perhaps to 2025. If so, they are a positive for global growth. Huge funds are circulating the world looking for attractive new investment opportunities. However, because not enough high-returning investments are available on a risk-adjusted basis, there’s been a massive inflow of funds into governmental treasury securities. Hence, these massive circulating funds are not promoting excessive global growth and inflation (best defined as “too much money chasing too few goods).

- Steel industry M&A activity will be huge; and, beneficial to a number of the players. It will be adding to the “economic rent” of the stronger companies. China’s Baowu is in the process of becoming a 200 million tonne per year producer. In the Pacific Basin, size is power.

- Steel “Age of Protectionism” will become even more potent. More trade suits and more products will be filed.

- Steelmaking capacity rationalization will be substantial. Look for: a) plant closings; b) consolidation of output at lower-cost plants; and c) more ways for a facility to be integrated with the output of other plants as multi-plant steel companies proliferate.

- Greenfield steel plant investments will be delayed and/or less frequently embarked upon. Promoters will have lessened confidence in the supply/demand outlook and more difficulty in funding the new units.

- The rising number of liquid steel futures curves, outside of China, will permit steel mills, steel scrap processors, middleman companies and others to “efficiently” hedge the steel price risk – i.e., at low cost. One of the potential positives with regard to this development may be an increase in the enterprise value of some steel companies as investors sense that earnings volatility is lessened because of the success in price hedging.

- Inflation in steelmakers’ operating costs may be nil in the next five years. Factors at work may include: a) lower prices for steelmakers’ raw materials; b) cost reduction efforts; c) consolidating output at the lowest cost plants; and d) lessened worker negotiating power. Regarding the last item, workers’ bargaining power is reduced because they are more fungible and replaceable – by machines making ever better usage of advances in artificial intelligence.

- Steel demand in China will ease. In turn, this development will be a potent factor driving down the international prices of iron ore and coking coal. (Note: However, the Chinese steel mills will continue to be aggressive exporters – often at ultra-low prices.)

- New trade patterns will evolve. One of the consequences will be opportunities for global sourcing at a lower cost.

- Ever-increasing globalization will necessitate the need to speed-up reaction times to competitive threats and opportunities. The steel industry is in an “Age of Management.” Well-managed companies have the opportunity to add to their company’s “economic rent.”

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2020 by World Steel Dynamics Inc. all rights reserved