The bad news for the steel mills is that, looking ahead to 2030, the global business environment will become even be more competitive; and, this development, along with steel industry changes, will add to the profit margin pressures on many steel companies. A fair number of the companies will not survive. The good news is that steel industry is sufficiently dynamic and complex for astutely managed steel companies to “kill and win.”

Following is WSD’s listing of positives, hopes, discordant opportunities and threats that will be impacting steel mills the world over:

POSITIVES

-

-

-

- Liquid steel futures curves outside of China will permit the steel mills and their customers to effectively hedge the price risk in steel scrap, rebar, hot-rolled band, coking coal, metallurgical coke and iron ore.

-

-

-

-

-

- Steelmakers’ raw materials – iron ore, coking coal and obsolete steel scrap – will be lower priced. The “Age of Lofty Iron Ore and Coking Coal Prices” has ended. Given the reduced negotiating power of steelworkers, inflation in steelmakers’ costs in the future will be minor.

-

-

-

-

-

- M&A activity in some cases – including China – will augment the steel mill’s pricing power. Mergers and acquisition are a permanent element of the “game of steel” – it resembles chess without checkmate.

-

-

-

-

-

- Steel’s new “Age of protectionism” came into effect in the fall of 2016 reflecting the avalanche of trade suits filed by many countries against the Chinese and other steel mills – in response to the devastating decline in steel export prices at the end of 2015 and early 2016. Steel prices in more home markets will lag price changes on the world market.

-

-

-

-

-

- Steel’s a management business. Astute steel managers will operate successfully within the many deep fissures and cracks in the steel industry’s industrial structure.

-

-

HOPES

- The formation of truly massive steel mills – including Baowu that’s on the path to becoming a 250 million tonne goliath – may lead to fewer pricing “death spirals” in the future – that is, if the mills are quick to reduce output when prices initially weaken.

- Steel demand outside of China will be stronger than expected as policymakers in more countries, in order to create jobs, boost steel-intensive fixed asset investment as a share of GDP.

DISCORDANT OPPORTUNITIES

- Lower steel scrap prices will bring down the production cost of EAF-based steel mills. Of course, this development reduces the “economic rent” of the integrated steel mills unless iron ore and coking coal prices decline as much. The EAF-based “mini-sheet” mills will increasingly match the product quality of the integrated mills.

- New technologies will attract new investment to in the steel industry like the moth to the flame. We are witnessing a reduction in the steel industry’s barriers to entry.

THREATS

- Chinese steel demand in 2021 is likely entering a period of long-term decline. Hence, the steel still mills in the next decade are facing more years of sizable oversupply.

- The Chinese steel mills once again, unlike the case in 2018, will be exporting HRB at a price that’s at the lower end of the price range.

- More stringent air pollution, water pollution and CO2 emission standards by 2030 will add to the mills’ production costs.

- An increasing number of mega-sized steel mills will be sitting at coastal locations in the Pacific Basin – which adds to price competition. And, another 70 million tonnes is under construction in China.

- Steel price volatility destabilizes the steel industry and worries those providing funds to the industry – including banks offering inventory loans. Price volatility contributes to many mill’s low enterprise values relative to their cash flows.

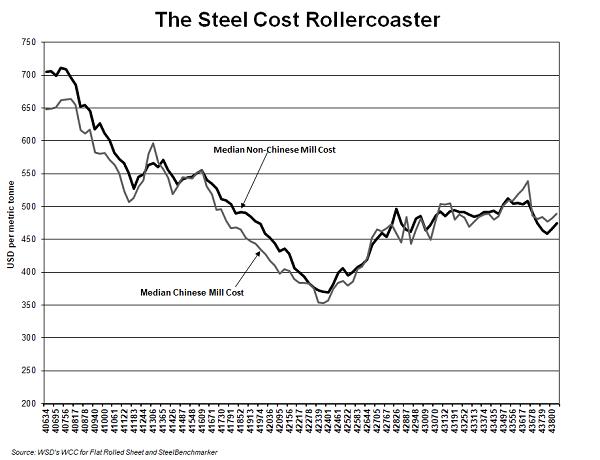

- The hot-rolled band World Cost Curve will resemble the tracks of a rollercoaster given the swings in the prices of steelmakers’ raw materials and, at times, sizable foreign exchange rate shifts.

- Much domestic pricing in the United States and Europe, and elsewhere, will remain tied to the ubiquitous weekly or monthly steel price indices.

- China’s steel industry will continue to “drive the steel industry’s bus.” Given that China’s “command” economy has far different characteristics than most economies elsewhere in the world, this situation will cause unexpected steel industry developments. In mid-2017, Chinese policymakers’ 100+ million tonne reduction in rebar capacity, in order to curb air pollution, created a steel shortage that boosted the country’s steel prices for a number of products, relative to export prices, through 2019.

- Automotive sheet market competition will become even more intense as more steel mills seek to produce this product. Higher-strength and thinner products will reduce tonnage deliveries of automotive sheet.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2020 by World Steel Dynamics Inc. all rights reserved