When the steel industry is in an extreme condition – i.e., when steel export prices are particularly high and/or especially low, it’s to be expected that the “spreads” between the prices of various steel and steel-related products are “out of whack:

In this memorandum, and each of the next two, we examine the history of three spreads over the steel cycle. Currently, given the steel industry boom and widened spreads, we are witnessing immense profitability for the many steel mills and their suppliers.

However, for steel middleman companies – a category that includes steel traders and steel service centers – it’s a time of high stress for two reasons:

- Steel that’s ordered at a fixed price, for delivery 8 to 10 weeks in the future, could be priced above the steel market price by the time it arrives.

- The current high prices in many cases are provoking a financial crisis because of the huge extra financial expense to carry the steel in inventory. Given the extra cost to carry steel in inventory, and rising ocean freight costs when this development is applicable, most middleman companies have fully utilized their bank credit – that, in normal times, may be only 35-65% utilized.

(Note: As well, steel mills seeking bank loans based on the value of their receivables as collateral, are finding that these loans are more difficult to obtain. Banks, for good reasons, are far more risk averse at today’s steel prices.)

Here are the following spreads:

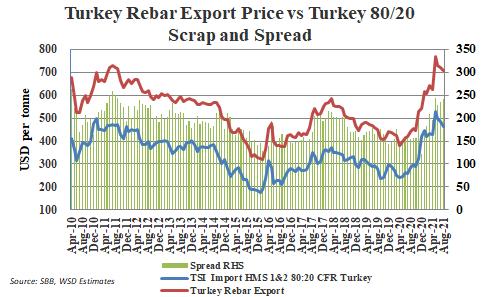

Spread 1: Steel scrap delivered to turkey versus the steel mills’ export price. The price of 80:20 heavy melting steel scrap delivered to Turkey is currently about $464 per tonne, with the Turkish mills’ rebar export price at about $710 per tonne – or, an amazing $246 per tonne above the scrap cost. In general, an efficient Turkish EAF steelmaker can convert the steel scrap to rebar, including placing the rebar on the boat for export, for about $160 per tonne. Hence, Turkish rebar producers are enjoying huge profit margins.

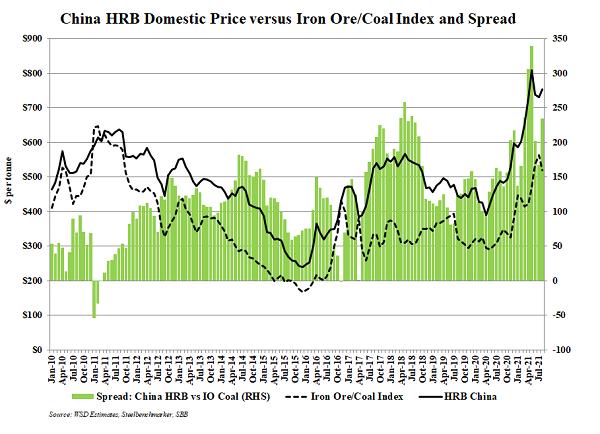

Spread 2: The Chinese hot-rolled band domestic price and their iron ore + coking coal cost. Since 2010, the spread has often been about $100 to $150 per tonne average. It has since spiked to about $300+ per tonne in recent months.

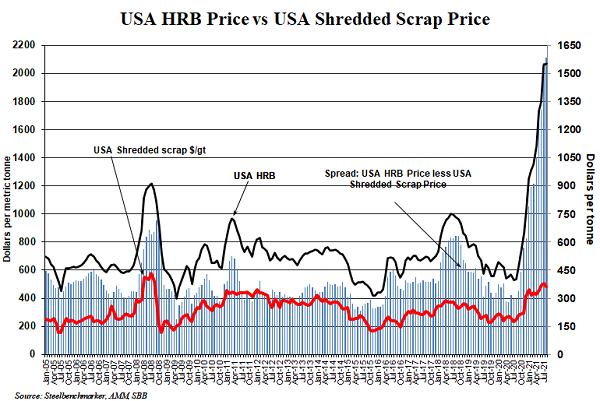

Spread 3: The U.S. hot-rolled band price, FOB the steel mill, and the price of shredded steel scrap delivered to the steel mill. Over the years, the typical spread has been about $400 per tonne. It has surged to about $1,500 per tonne.

As of July 2021, The spread between the non-Chinese median-cost mill’s hot-rolled band operating cost at $600 per tonne and the export price of hot-rolled band at $980 per tonne, FOB the port of export, is about $380 per tonne (prior to $15-25 per tonne to ship the product to the port of export). Looking back to 2010, the spread has often been about $50 to $100 per tonne.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2021 by World Steel Dynamics Inc. all rights reserved