The global steel industry may be on the cusp of a more sustained rise in its profitability over the steel cycle. The critical factor provoking this possible change is the enormity of the Chinese steel industry’s air and water pollution and its CO2 emissions. These emissions can no longer be tolerated by the Chinese government since it is committed to a less polluting environment for its citizens. China, more than any other country, has the wherewithal to reduce CO2 emissions due to the availability of massive capital funds to dedicate to this purpose and the existence of construction companies that build new facilities rapidly and at a cost often 40% lower than elsewhere in the world. Will limits to Chinese steel production, probably for years to come, become one of its government’s core initiatives as it seeks to improve air quality and lessen CO2 emissions?

WSD is considering two scenarios, both of which are judged to have about equal odds of occurrence – although, we are hoping as 2021 progresses that new developments permit us to boost the odds one way or another based on new information.

SCENARIO “OLD”

Scenario Old (50% odds) is an extension of the industry environment that we’ve been observing the past two decades. Competition is particularly fearsome on the world export market, especially during times when there’s oversupply in China and its mills’ exports are surging. There are too many mega-sized steel mills sitting at coastal locations in the Pacific Basin. The current “Age of Protectionism,” that came into effect in 2016 after a particularly severe pricing “death spiral” for hot-rolled band in the world market in late 2015 is helping many of the mills obtain higher domestic price realizations; however, it has also added to competition on the world market since there are fewer countries open to foreign deliveries. Prices have become more competitive in a number of specialty products because of oversupply. The pricing structure for these products has been “commoditized.”

A profound new development the past few years, threatening especially to the survival of higher-cost integrated steel plants, is the requirement to sharply reduce CO2 emissions in the next few decades. Such an achievement requires huge capital expenditures, a sizable rise in operating costs, reasonably priced renewable power and the development of new technologies that enable the production of low cost hydrogen (to be used in steel and related processes in lieu of natural gas and coal). The steel mills are now rushing to make promises, in public, about their commitment to lessen CO2 emissions in the future. In fact, otherwise, they will be deemed to be poor corporate citizens – which could impact their already low enterprise values.

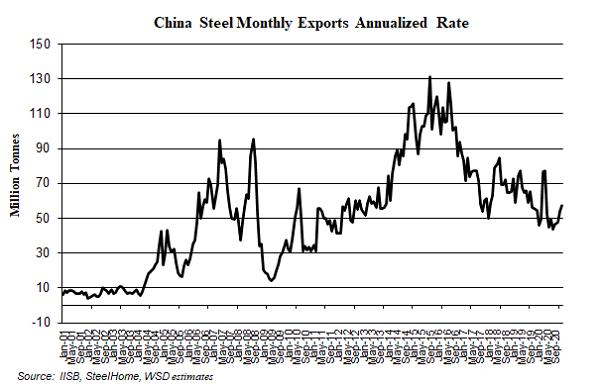

As WSD has written time and again, the Chinese steel industry has been “driving the industry’s bus.” The most sizable growth of demand has occurred in China, where the steel intensity of the economy is now so extreme that a sizable decline in steel demand is expected by 2030 due to lessened steel intensity. However, near-term, Chinese exports may be surging back to the 65-80 million tonne annual rate – based on anecdotal evidence that the mills’ bookings are up sharply from the December 2020 annual rate of about 58 million tonnes and 54 million tonnes for all of 2020.

SCENARIO “NEW”

In this case (50% odds), the Chinese steel mills are no longer an extremely serious threat to the well-being of their offshore competitors. China’s policymakers in 2021, and for sure in the next several decades, will be limiting Chinese steel production by mandate because: a) the country has such severe air and water pollution and CO2 emissions problems: b) the country’s leaders are fully committed to overcoming these problems; c) the country has the resources to be transformed to a carbon free condition by 2060 – as forecast by President Xi Jinping in September 2020; and d) the steel industry is one of the worst contributors to the global pollution problem. Most of China’s mid-sized and larger steelmakers are closely tied to their local municipality’s directives – and, the municipalities are in effect “owned” by the Central Government. If the top officials in a municipality don’t heed the instructions that come down from the top, they will lose both their job and prized retirement benefits.

China’s biggest challenge when it comes to CO2 emissions is the country’s consumption of about 4 billion tonnes of coal each year, with each tonne burned emitting about 2.3 tonnes of CO2 into the atmosphere. The great preponderance of the coal that’s consumed is for use in electricity generating power plants. However, China’s steel industry is also a major user.

In 2020, the Chinese steel industry’s blast furnaces produced about 850 million tonnes of pig iron and, in the process, probably consumed about 600 million tonnes of coal that was converted into coke – at roughly 1.45 tonnes of coking coal per tonne of metallurgical coke – and/or processed into pulverized coal for direct injection into blast furnaces, and/or to power the electricity generating plants owned by the steel mills.

One of the consequences in 2021 of a limit to Chinese steel production could be a significant rise in the country’s imports of slab, billet and hot-rolled band. In fact, if Chinese steel production in 2021 is restrained to 2020’s output of 1.05 billion tonnes and the global economy expands on a synchronized basis, we think that steel shortage conditions could resume as soon as the third quarter of 2021. The numerous mega-sized steel plants sitting at coastal locations in the Pacific Basin would have an outlet for their excess slab and hot-rolled band capacity – including a major new integrated greenfield project just under construction in the Philippines.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2021 by World Steel Dynamics Inc. all rights reserved