Question: What’s the difference between steel industry protectionism and true love? Answer: Protectionism is forever!

Steel mill profit boom

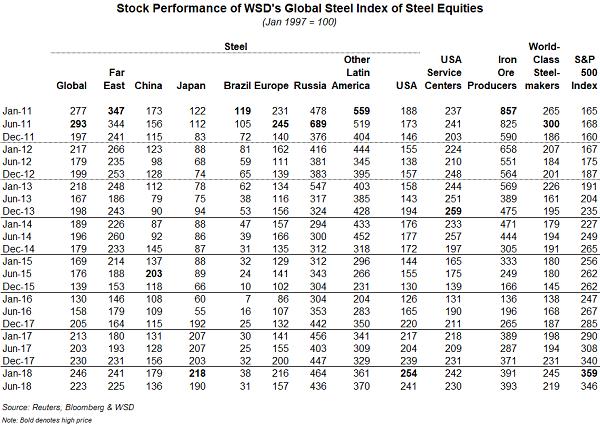

Steel trade restraints – i.e., steel’s “Age of protectionism” – have become an important upside profit driver for a sizable number of non-Chinese steel mills. As well, the Chinese mills are benefitting currently from a tight supply/demand balance in their country for rebar and hot-rolled band. Steel company equity values have surged since early 2016.

Steel industry protectionism seems destined to remain in place well into the 2020s. Here’s why:

- Steel mills must push for trade protection because no other approach works. No longer can they concentrate sufficiently via M&A activity, following an episode of ultra-weak export prices, to restore their pricing power because, nowadays, there are simply too many mills offering steel for export.

- At least 50 steel mills are positioned to sell hot-rolled band on the world market including 4 in Russia, 1 in Ukraine, 3 in Eastern Europe, 5 in Western Europe, 2 in Turkey, 5 in the Middle East and North Africa, 1 in Iran, 3 in India, 2 in Indonesia, 2 in Thailand, 8 in NAFTA (the USA, Mexico and Canada) and 20+ in China.

- Oversupply in China for hot-rolled band is forecast by WSD to recur in the second half of 2018. Although, as the winter months approach, mandated steel production cutbacks in Northern China, in order to combat the winter’s more severe air pollution problems, will help to sustain the supply/demand balance. Probably not until 2019 will the HRB oversupply in China be sufficiently prolonged to drive the HRB ex-works price down to the median mill’s marginal cost. China’s HRB marketplace is highly competitive as about 68 wide hot strip mills are battling for market share.

- President Trump’s “America First” policy, that plans duties on a variety of manufactured products entering the USA, has provoked retaliatory duties by the USA’s trading partners on imports of USA manufactured goods and agricultural products. Hence, protectionism is on the rise – although, perhaps, to a lesser extent than many fear as new trade deals are negotiated with the USA’s trading partners. (Note: President Trump’s “America First” policy, is seeking to shift the benefits of mercantilism from China to the United States.)

- Government policymakers in many countries are now more receptive to their steel mills’ pleas for protection than a decade ago. Policymakers worry that computers – i.e., artificial intelligence – will replace workers at an alarming pace. Hence, there’s a need for rising fixed asset investment – i.e., construction and capital spending – to create new jobs.

- China’s expanding Global Financial Colonial Empire is “rocking the capitalist boat.” As part of its effort to play a greater role in supporting Developing World infrastructure projects, China in 2016 created the Asian Infrastructure Investment Bank (AIIB). The AIIB now, as well, receives some financial support from governments in a number of advanced countries. To date, the AIIB has made about $5.5 billion of investments. The AIIB activities, and the consequent expansion of the Chinese Global Financial Colonial Empire, are stimulating China’s exports of goods and services to Developing World countries.

- The competitive nature of the global steel industry is a part of its DNA. Hence, this factor boosts the mills’ wish for protectionism and other developments that enhance their “pricing power.” Characteristics of steel companies often include high capital intensity (i.e., the investment needed to build a new plant relative to its revenues), high fixed costs, the delivery of commodity products, technological threats and a high assembly cost for raw materials. The mills, as well, are impacted by shifts in regional steel demand, changing steel trade patterns and new currency values.

The steel marketplace is prone to “chills” in which steel buyers hold back from purchasing because they fear price declines; and, at other times, “buying panics” whereby steel buyers order further in advance because they fear price increases and product availability.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2018 by World Steel Dynamics Inc. all rights reserved