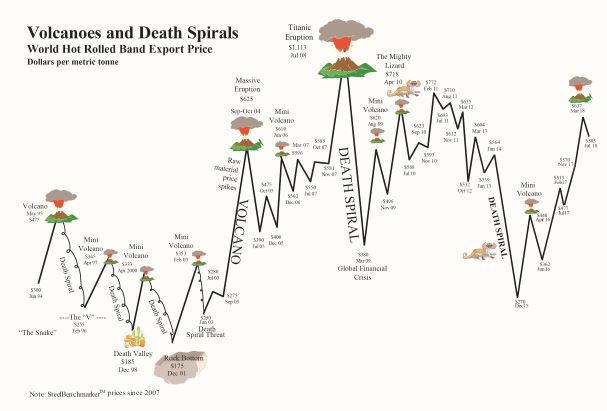

Steel pricing “Death Spirals” may have surprising consequences

- For steel buyers, a pricing “death spiral” is positive because they can purchase the steel at a much lower price. However, if the buyer is carrying substantial inventory and/or has placed sizable orders in advance at a high price, the consequence can become a financial calamity.

- For steel mills, a price collapse adds to financial stress, especially when the plummeting price is accompanied by a sizable reduction in the operating rate. However, the price collapse promotes changes in the industry’s “industrial structure” including capacity rationalization.

Pricing “death spirals” accelerate the pace of change. Here’s a past and a forecast example:

- THE PAST. In December 2015, hot-rolled band on the world market on the world market fell to $270 per tonne, FOB the port of export, versus the high of $494 in January of that year. At $270 per tonne, the price was $40 and $75 per tonne below the marginal cost of the median-cost non-Chinese and Chinese steel mill, respectively. It was, by far, the lowest in history relative to the steel mills’ cost. Adding to the mills’ alarm, underlying global steel demand was little changed. Unlike the past, the non-Chinese steel companies were not able to consolidate sufficiently in order to regain “pricing power” – there were far too many sellers on the world market.

The non-Chinese steel mills’ solution to this crisis was twofold: First, file an avalanche of steel trade suits against the Chinese steel mills and others; and, second, convince government policymakers that trade protection was essential if they were to turn in a satisfactory financial performance. What was the consequence? In the fall of 2016, the steel industry entered an “Age of Protectionism.”

- THE FUTURE. A HRB pricing “death spiral” is forecast in China in 2019 when there’s sizable overcapacity for this product. When combined with a reduced operating rate, in part because governmental actions will likely be restraining steel exports, the steel mills’ profits will be plummeting. At that point, WSD expects more of the country’s municipalities and provinces, as well as the Central Government, to assist the companies in their capacity reduction efforts. Governmental funds will be provided for worker re-training. In some cases, steel company debt will be swapped for equity. Short-term steel company bonds will be sold to the public, as was the case in 2016 when perhaps $30 billion was raised to help carry the companies through the trough. Steel plants in city centers will be closed because the land is too valuable to be occupied by poor-performing and highly polluting steel mills – since the land can be exploited for commercial, industrial and residential purposes.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2018 by World Steel Dynamics Inc. all rights reserved