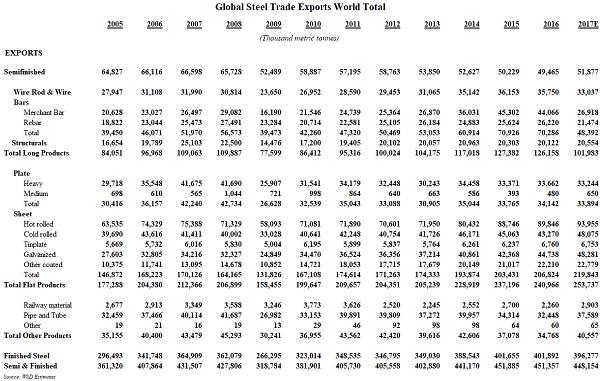

Global steel trade including semis rose in 2017 to an estimated 448 million tonnes from 361 million tonnes in 2005 – for a compounded growth rate of 1.8% per annum. During this period, trade in finished steel products rose 2.5% per annum to 396 million tonnes, while trade of semi-finished steels fell 1.8% per annum to 52 million tonnes.

In 2017, global exports of hot-rolled sheet were about 90 million tonnes, which was well above the exports of 48 million tonnes each for cold-rolled sheet and galvanized sheet, and 38 million tonnes for pipe and tube.

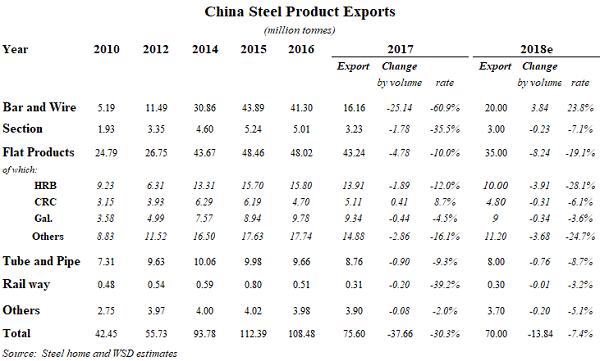

Given steel production in 2017 of 1.71 billion tonnes and a yield to finished steel products of 89.5%, finished steel product output was 1.53 billion tonnes. Trade in finished steel products at 397 million tonnes amounted to 26.0% of production. When subtracting China’s exports last year of 75 million tonnes and its steel production of 854 million tonnes, non-Chinese steel exports of 322 million tonnes amounted to 42.0% of non-Chinese steel product output of 766 million tonnes.

Given the importance of the steel export business, no wonder it’s a major event when the world export price collapses. In the past, when this has happened, the mills have sought to consolidate as a means to recapture “pricing power.” Nowadays, the consolidation strategy no longer works because there are too many players. But, the mills have found a better solution – it’s a new “Age of Protectionism” created by the avalanche of steel trade suits since 2016 filed against the Chinese steel mills.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright Ó 2018 by World Steel Dynamics Inc. all rights reserved