The steel industry-specific dynamics driving the marketplace situation during the second half of this year could easily be described as the “inverse” of the upside forces contributing to first-half 2023 upside:

- Assuming steel output ex-China rebounds during the first half in the face of rising apparent demand and improving margins (i.e. “spread”), crude steel output could amount to 840-860 million tonnes annualized in May-June. Could this level of output be excessive come mid-summer, especially if buyers have re-stocked sufficiently during the first half and underlying steel demand remains anemic? Consider:

-

- A further 3% decline in real steel demand versus the first half would amount to about 850 million tonnes annualized; a figure that is roughly on par with last year’s second-half apparent consumption levels estimated at 861 million tonnes annualized.

-

- Should buyers decide to reduce inventories by the equivalent of 2 weeks of demand, apparent consumption could temporarily fall to about 815-820 million tonnes annualized.

-

- Assuming Chinese net exports, on a crude steel equivalent basis, remain roughly flat on a year-to-year basis at 50 million tonnes annualized, the requirement for crude steel output ex-China would amount to ~770 million tonnes annualized.

Hence, it would seem highly likely that overproduction in the world ex-China represents a significant risk for steel prices come second half of this year, especially if steel demand remains largely stagnant and especially if demand falters.

- Steelmakers’ raw material prices, especially the price of coking coal, appear poised for a substantial downward correction later this year:

-

- Coking coal prices, according to one WSD contact, are bound for a “collapse” unless steel demand surprises to the upside, and even that may not be enough. The importance of coking coal prices at present is underscored by the fact that it makes up about 62% of the iron ore/coal “cost basket” at present versus only about 32% at this time last year. Much of the current upside for prices is rooted in supply-side issues, the forecast downside appears to be tied to a robust reversal of the same:

-

-

- Chinese metallurgical coal imports grew about 15-20% versus the prior year in 2022 to ~64 million tonnes, with a large portion of the increase attributable to a recovery in imports from Mongolia; the latter, estimated at about 30-35 million tonnes in 2022, were greatly impaired from mid-2020 until late-summer 2022 due to Covid-related restrictions and logistics issues. Imports from Mongolia are expected to increase perhaps 10-20 million tonnes in 2023 versus last year’s levels, as the number of trucks crossing the border has surged to well over 800-900 per day from a low of ~400 per day in early-2022.

-

-

-

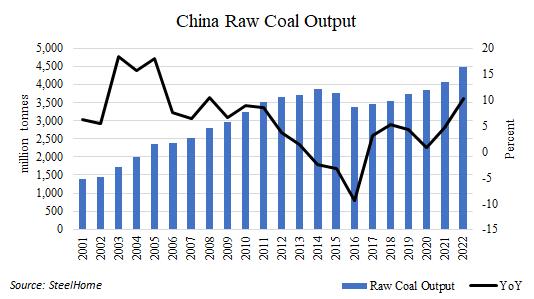

- China’s coal output (including both thermal and metallurgical grades with the latter not reported separately) surged about 10% in 2022 to ~4.5 billion tonnes, establishing an all-time high. Coke production amounted to about 473 million tonnes in 2022, implying coking coal demand of about 670-680 million tonnes. Assuming minor changes in inventory, the implied metallurgical coal output in China would have been about 605 million tonnes. A modest 2% increase in met-coal output next year would add another ~12 million tonnes to domestic supply, in lieu of imports.

-

Of course, unexpected production declines are rarely out of the question when it comes to coal output; however, WSD sees an increasing likelihood that a substantial correction in met-coal prices could materialize in the second half of this year to $220-250 per tonne, FOB Australia, on the back of four key forces: a) a muted outlook for pig iron production growth both in and outside of China; b) growth in seaborne supply; c) normalization of weather-related issues that are currently constraining shipments and mining in Australia; and d) the end of “crossover” demand from the energy sector that reportedly sapped the availability of various met-coal grades last year, driven by a surge in thermal coal prices that “pulled” supply of these grades away from steel mills.

-

- Iron ore and steel scrap prices could be well down from their highs likely to be achieved in the next two months as seasonal factors aid in improving supply with demand – especially in China – remaining relatively disappointing year over year. A pullback in the iron ore price, delivered to China to about $100 per tonne or lower in the third quarter would not be surprising on this basis.

A reduction in iron ore and coal prices of this magnitude would reduce steelmakers’ production costs by as much as $150-200 per tonne of hot-rolled band versus the expected peak price levels in the weeks ahead. Combined with the increased likelihood of steel overproduction as early as May/June, WSD would not be surprised if the price of hot-rolled band, FOB port of export, decline substantially by mid-summer.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2023 by World Steel Dynamics Inc. all rights reserved