WSD has repeatedly pointed out that the metaphorical Chinese steel industry “Bus” – one that has driven global industry trends for the past two decades – has crashed in 2022 and is badly in need of repair. Since late-2022, Chinese policymakers have begun responding to these realities. Emergency crews are being dispatched to the scene of the “crash,” and evidence has emerged that some assistance might be provided to several of the badly damaged components of the economy and, by proxy, steel demand.

A speculative rally drove up the Chinese domestic price of hot-rolled band by about $40-50 per tonne at the end of 2022, with another $10-15 per tonne of upside having materialized prior to the Golden Week Holiday, which took place relatively early in the Western calendar year in 2023 (during the third week of January). Some WSD contacts point out that a substantial portion of the already-concluded “rally” in the price was attributable to the weakening RMB, which depreciated from 7.2/$US to 6.7/$US from November 2022 to February 2023.

Others suggest that the “rally” was a no-brainer from the perspective of steel traders and speculators as the price of HRB was essentially reflecting the cost of production – hence, the steel being purchased was unlikely to be priced much lower in the future. Surveying a number of contacts yields a common denominator of opinion regarding the outlook for economic activity and steel demand in 2023:

- The abandonment of “Zero-Covid” appears to be fully accepted in the minds of Chinese policymakers, with the “hope” that a rapid spread of the virus during the first calendar quarter of 2023 leads to a subsequent stabilization, allowing a resumption of “normal” economic activity and growth thereafter. In WSD’s view, this could prove to be a rather optimistic scenario with continued economic challenges potentially persisting through the first half of 2023.

- A “magical instant recovery” of the Chinese property market is not in the offing, at least until the second half of the year, and could possibly take longer. Whilst a number of stimulative and monetary policies have been announced and implemented, the immediate impact is likely on completions of existing housing projects that have stirred unrest in the past year. A dramatic upturn in property sales would require a significant boost in consumer confidence, and likely further stimulus measures, which could take time to materialize.

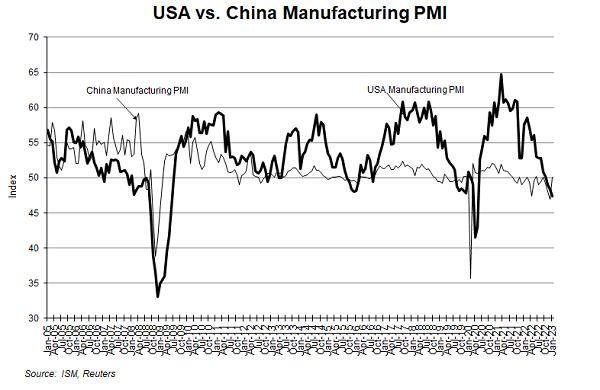

- China’s export economy, which has enjoyed incredible growth in the past two years despite a series of trade “spats” with the USA, EU and other key markets, is still likely to face headwinds as consumer demand in the World ex-China slows

-

- Other segments, such as automobile sales and production, which performed quite admirably during 2022 posting 3.3% growth in vehicle sales to date, could see somewhat slower growth in 2023 given the large “base effect” and a highly challenging environment during the first half of 2023.

- Infrastructure spending and activity, which posted double-digit growth in 2022 and essentially “bailed-out” steel demand this year, could slow to low-single-digits in 2023.

Despite the recent optimism and based on the aforementioned realities, WSD remains skeptical of a massive upward shift in Chinese apparent steel demand for 2023.

Recent economic data provides growing evidence that the economy is indeed on a slower footing. The manufacturers’ PMI (Purchasing Managers’ Index) reading was only 47 for December 2022 and rose to merely 50.1 in January 2023, suggesting that growth of China’s manufacturing sector has stalled. Nevertheless, sentiment in China has improved rapidly since the abandonment of “zero-Covid” policies and China’s “Bus” is refueling, with the GDP growth forecast to surge to 4.5- 5.5% in 2023 according to a number of economists. Sustaining a recovery of this magnitude will most certainly require additional government reforms and further monetary and fiscal support.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2023 by World Steel Dynamics Inc. all rights reserved