The global “Green Revolution” is strongly impacting the steel business

A critical development in the past two years is the loss of confidence on the part of many owners of “legacy” steel mills – that, outside of China, have roughly 300 million tonnes of capacity (or, about 50% of non-Chinese annual integrated steel mill capacity of about 600 million tonnes). These plants are apparently not positioned to be reconfigured to emit far less CO2. As a consequence, a number of these plants are being sold at bargain prices – such as Arcelor-Mittal’s sale of its northern USA steel plant asset to Cleveland-Cliffs for about $1.4 billion (that boosts Cleveland Cliffs to the #1 steel producer for flat-rolled steels in the USA).

Longer-term, with the industrial structure of societies being revamped to make use of renewable energy, the rise in steel demand can be substantial, perhaps as much as 50 million tonnes per year. Huge investments are needed to create renewable electric energy – wind and solar power outside of China, plus nuclear power in China.

Some “Green Revolution” pros and cons for the steel mills include:

Positives

- Policymakers in many countries the past two years have become more supportive of the steel mills’ huge capital needs, and 20-50% rise in operating expenses, if they are to sharply pare CO2 emissions. Hence, they are more prone to erecting trade barriers to protect their steel mills.

- Steel mills the world over are “talking a good game” when it comes to their plans to reduce CO2 emissions. They are demonstrating flexibility in their choice of solutions to reduce CO2 emissions – based on the availability of hydrogen and/or or the capture, processing and sequestration of CO2.

- Policymakers in the European Union are in an advanced stage of imposing carbon border taxes on imported steel products based on the generation of CO2 during the manufacture of the product. Such an effort requires the existence of a “carbon exchange” on which the price of a tonne of CO2 is determined.

- China is best positioned to pare CO2 emissions given the immense funds that can be diverted to this effort. Similar to huge infrastructure projects, the near-term return on investment is only of minor consequence to Chinese policymakers.

- The Green Revolution challenge will boost many countries “steel intensity” via the mechanism of rising fixed asset investment as a share of GDP.

Negatives

- The funds needed by the steel mills to become carbon free producers is prodigious – along with a massive infrastructure spending on the part of their government to provide renewable electric power at a low price. Capital spending needs for the global steel industry to achieve its CO2 reduction goals exceed $1 trillion in the next 20 years.

- The companies need major government support in order to achieve a low CO2 emission status – no matter which political party in their country may be in power in the future.

- A “level playing field,” in which policymakers in all countries in the next thirty years pursue complimentary actions to reduce CO2 emissions, is most probably a “pipe dream.” Hence, steel producers in countries with less severe mandates to cut CO2 could have a cost advantage.

- If CO2 emissions are to be largely eliminated, the rise in operating costs – when the process route either makes use of hydrogen to produce the steel and/or to capture, process and sequester the CO2 that’s emitted – will typically range from 25% to 50% for an integrated steel plant. For EAF-based steelmakers, its operating costs will be inflated by the high prices for prime steel scrap and related products (directly reduced iron and purchased pig iron).

- Many countries will not meet their renewable energy production targets because they lack the funds to accomplish such an undertaking.

- Nuclear plants may be the best way to create renewable energy sources because only a small amount of CO2 is emitted when the nuclear fuel is processed. But, in a number of countries/regions outside of China, these plants are not included as a renewable energy source.

- Higher steel prices will accelerate efforts by steel users to engineer their steel-intensive products to use lesser amounts of steel – i.e., price allocates resource.

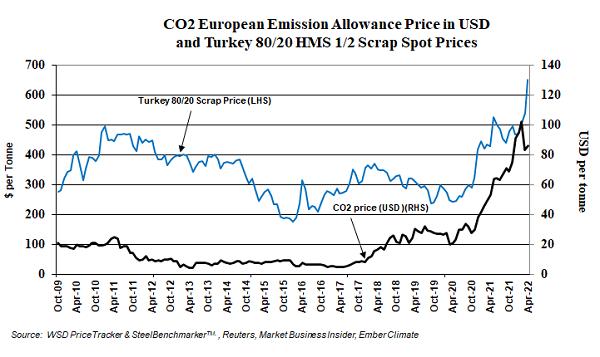

- The price of carbon is now impacting steel prices in the European Union, which will cause them to be higher than in many other parts of the world. Since 2018, as indicated in the accompanying graphic, the European price of carbon was so low that it had little correlation with the price of 80:20 steel scrap delivered to Turkey. However, this situation changed once the EU carbon price started to rise sharply in 2018 and peaked in Feb. 2022, the price has since been trending down in the last few weeks.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2022 by World Steel Dynamics Inc. all rights reserved