China Still Driving the Steel Industry “Bus” – Off-Road Edition

As has been the case for the better part of the past two decades, the economic and steel-industry-specific situation in China continues to drive the global industry outlook in a number of respects. Historically, WSD has referred to this phenomenon as China “driving the steel industry ‘Bus’” – in the latest instance, the Chinese “Bus” has taken a detour off-road, with the key question looming: “For how long and how bumpy of a ride?”

From January to April 2022 and, in reality dating back to late-summer 2021, the ride has been one of the “bumpiest” since the 2014-2016 period from the viewpoint of steel demand, prices and industry profitability. Consider:

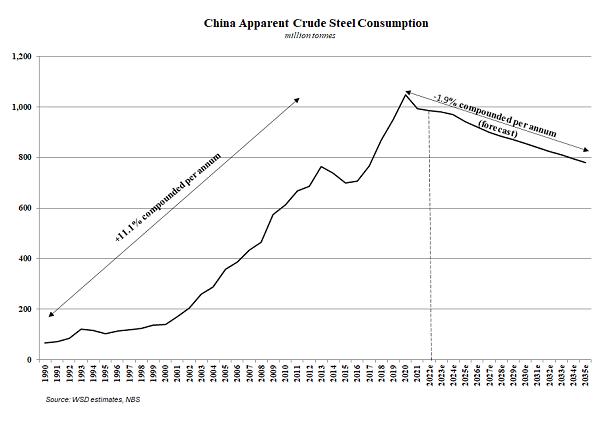

- In 2015, Chinese Apparent Steel Consumption fell for the first time in at least 5 years on a year-to-year basis from 727 million tonnes in 2014 to 692 million tonnes – a 4.8% decline – with a corresponding decline in the domestic price of hot-rolled band from $443 per tonne in 2014 to $301 per tonne in 2015 or -32% decline year to year.

- Based on January to April data, Chinese apparent consumption remains depressed at about 994 million tonnes annualized, roughly 9.8% below the H1 2021 figure of 1.1 billion tonnes

The latest bout of Chinese economic and steel-demand related anemia is largely attributed to the near-complete “Covid lockdowns” of population and accompanying economic activity in a number of major Chinese cities aimed at preventing the spread of the disease, with Shanghai among the highest-profile targets of this tactic. The economic impact has been astounding, with the prevailing expectation that GDP during the second calendar quarter could outright decline on a year/year basis, following a lower than hoped figure of only 4.4% growth during the first quarter. A slew of economic indicators in April are flashing “bright red” on a year-over-year basis:

- Retail sales saw a decline of 11%, following a ~4% decline in March

- Property sales were down 40%

- Vehicle purchases were down more than 30%

- New housing starts were down nearly 45% after a 22% decline in March

- Industrial production was down 3% after rising 5% in March

- Fixed Asset Investment growth plummeted to only 2.3% versus 7.1% in March, with Infrastructure investment slowing to 4.3% growth from nearly 12% in March

- Export growth moderated to ~4% down from almost 15% in March

- Meanwhile, PPI remained at about 8% (versus 8.3% in March) and CPI increased to 2.1% in April from 1.5% in March

This calamitous situation is unfolding against the backdrop of a government target of 5.0-5.5% full-year GDP growth in 2022 with the high-profile People’s BBJB Congress looming in October of this year – a potentially monumental event as current President Xi is widely expected to remain for a third term in “office” – a break from tradition of no more than two office terms observed since the Mao era. The symbolic importance of this upcoming event cannot be understated and the economic performance to date in 2022 is certainly weighing on Chinese policymakers, as evidenced by the recent spate of announcements aimed at loosening financial conditions, as well as not so subtle encouragement for business to “resuscitate” at all costs.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2022 by World Steel Dynamics Inc. all rights reserved