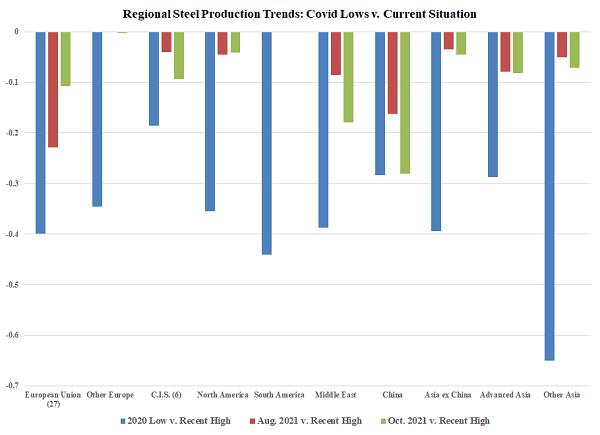

Since the inception of the Covid-induced economic downturn, WSD has carefully monitored regional steel production trends as an indicator of potential changes in steel prices, especially as regions with depressed production levels (relative to a recent “peak” level in the 24 months just prior to Covid) show signs of normalizing their output. Recent figures suggest that production upside is becoming increasingly limited in a number of countries where, at least on paper, significant latent capacities still reside:

- In North America, and the USA in particular, upside appears limited as the roughly ~5 million tonnes per year of “under-production” are mostly accounted for by the reduction in crude steel output at various integrated steel mills whose blast furnaces have likely been retired for good (such as the US Steel Great Lakes Works operation and one of the blast furnaces at the USS Granite City Works, among other examples).

- In Japan, a similar situation is underway with the country’s leading steelmaker by volume, NSSMC, reaffirming its intent to reduce output in the country by nearly 10 million tonnes per annum in the years ahead. In early-2021, Nippon Steel announced 5 blast furnace closures in total from 2021-2024, bringing the total number of operating furnaces down from 15 to 10. These include blast furnaces closures No. 1 and No. 2 in Setouchi Works Kure Area by 1H2021, Blast Furnace No. 1 in Kansai Works Wakayama Area by 1H2021, Blast Furnace No. 3 in East Nippon Works Kashima Area by end of fiscal 2024, and the previous closure of Kyushu Works Yakata Area Blast Furnace No. 1 in fiscal 2020. In addition, NSSMC also plans on permanently idling the Yamaguchi Works EAF by the end of fiscal 2023. In all, the approximate total crude steel capacity reduction is just below 14 million tonnes per annum.

- In the CIS, where current under-production is about 10 million tonnes per annum relative to the recent high, nearly half of this figure is concentrated in Ukraine, where recent and possible near-term political turmoil are likely to limit steel production upside. Similarly, Russian steel production upside appears limited at least in the immediate future (2-6 weeks) as one of the largest BFs in the country is undergoing maintenance at a major export-oriented plant, according to WSD contacts.

- In the EU, the latest wave of Omicron-related lockdowns is likely to limit steel production in the months ahead.

- In the Middle East, despite a substantial level of under-production based on the latest reported statistics, WSD contacts indicate Iran producers are aggressively seeking export orders for semi-finished steel products. Higher electricity and natural gas prices are leading to a massive surge in production costs for EAF producers the world over; hence, it would not be surprising to see a number of these producers turning to low-priced billet on the world market as a substitute for their own high-cost melt in the weeks ahead.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2022 by World Steel Dynamics Inc. all rights reserved