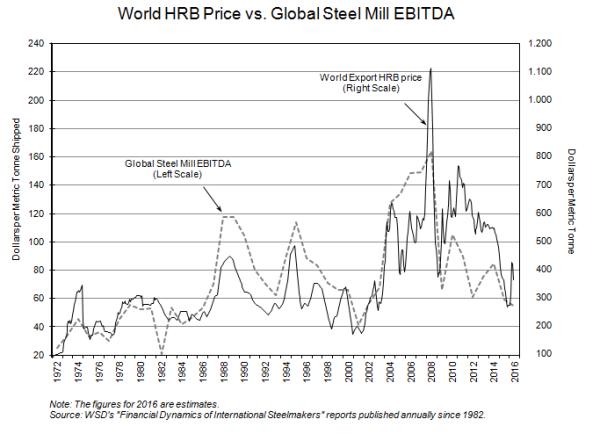

At least since the early 1970s, the evidence is persuasive that the world export price for hot-rolled band is the key indicator of global steel mills' profitability. When the export price is high, the domestic steel mill gets a better price in its home market because, otherwise, it will boost its exports. When the export price is low, the domestic mill has much-reduced exporting opportunities and, as well, is likely to be confronted with low-priced foreign steel in its home market.

Is this situation about to change because of the incredibly low hot-rolled band export price that prevailed at the end of 2015. At that time, the Chinese mills were offering to export hot-rolled band at about $75 per tonne below the marginal cost of their median-cost mill. Concurrently, many leading international steel mills decided to cut their price close to the Chinese mills' price, delivered to the offshore customer. Why? They no longer could tolerate a further sizable decline in their share of world export deliveries even though this might continue to drive down the world price - which it did - and, this drove them into a condition of "financial calamity."

Looking ahead, might the world export price be a less potent profit driver? WSD suspects the answer, at least statistically speaking (looking after the fact), is "probably not." Although, a rising number of steel mills have cajoled their governments into providing them with significant import protection reflecting: a) the damage caused by the collapse of the world export price late last year; and b) the prospect that the global steel industry is facing more than a decade of significant oversupply as Chinese steel demand seems likely to decline at least 100 million tonnes in the next decade.

In those countries where the mills have been able to: a) create a "fortress" condition with regards to domestic steel versus foreign steel; and b) the number of suppliers is not so substantial (not the case in China and perhaps not the case in Western Europe), the steel mills have the potential to generate a good profit margin even when the world export price is depressed.

What does WSD conclude? For the steel mills, protectionism and mercantilism are great and free/fair trade is bad. Is this good or bad for the country? That's another subject. In 1971, this writer joined Mitchell Hutchins, a well-regarded Wall Street research boutique. In the office next to me was Larry Ross, the top-ranked paper analyst in the country. He said to me: "Peter, do you know that what's good for the steel industry is bad for the country?"

Please note that, in the accompanying graphic, the scale is 12:1 for the export price per tonne and major international mills' EBITDA per tonne. Hence, there's a one-to-one relationship between the figures.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2016 by World Steel Dynamics Inc. all rights reserved