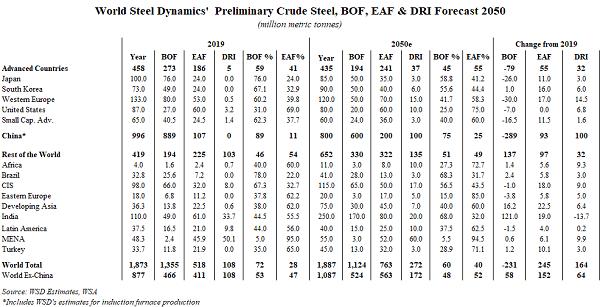

WSD’s forecast for “possible” global steel production in 2050 is about 1.887 billion tonnes; or, up 14 million tonnes from the 1.873 billion tonnes produced in 2019. Chinese output falls 19.7% to 800 million tonnes from 996 million tonnes in 2019 Advanced Country output in 2050 declines 5.0% to 435 million tonnes from 458 million tonnes, respectively; and, the Rest of World output rises 55.6% to 652 million tonnes from 419 million tonnes, respectively. The highest growth is for the Rest of World at 1.4% per year compounded over the 31 years.

- The only Advanced Country with a rise in production is South Korea because we include North Korea in the total – with total Korean output in 2050 at 90 million tonnes versus 73 million tonnes in 2019. Once there is a merging of the two economies, we expect a massive gain in steel demand in North Korea. Interestingly, similar to Vietnam, South Korea, Japan, Taiwan, Indonesia and China, North Korea has deep-water ports on its east and west coasts that would be a great location for a new mega-sized steel plant.

- In the Rest of World, the largest gain in steel output takes place in India with estimated output in 2050 at 250 million tonnes versus 110 million tonnes in 2019. Yet, our Indian forecast is at least 125 million tonnes below the expectation of many pundits in India and elsewhere.

- In China, although output declines to 800 million tonnes in 2050 versus 996 million tonnes in 2019, electric furnace steelmaking output rises to 200 million tonnes versus 107 million tonnes in 2019.

Global BOF steel production in 2050 is forecast at 1.124 billion tonnes, down 17% from 1.355 billion tonnes in 2019. Advanced Country output falls 28.7% to 194 million tonnes from 273 million tonnes; Chinese output plummets 32.5% to 600 million tonnes from 889 million tonnes; and ROW rises 59.0% to 307 million tonnes from 193 million tonnes.

Global EAF steel production in 2050 is forecast at 763 million tonnes, up 47.3% from 518 million tonnes. Advanced Country output rises 29.6% to 241 million tonnes from 186 million tonnes; Chinese output surges 87% to 200 million tonnes from 107 million tonnes; and ROW output increases 43% to 322 million tonnes from 225 million tonnes.

Obsolete steel scrap generation will surge by 2050 since the global reservoir of this scrap, that’s 10-40 years old, will have more than doubled to about 32 billion tonnes from 14.4 billion tonnes in 2019. If we divide these figures by 31 to take into account the 10-40 years old age of the reservoir, obsolete steel scrap generation in 2050 is more than 500 million tonnes higher per annum than in 2019.

DRI output rises to about 272 million tonnes in 2050 versus 108 million tonnes in 2019. Granted that electrolyzers are able to produce hydrogen at low cost via electrolysis, because they have been designed to generate huge quantities of hydrogen using bargain-priced renewable electric power, more than 50% of the rise in DRI output is carbon free – because it’s hydrogen based.

The 164 million tonne per annum rise in DRI output by 2050 consists of 100 million tonnes in China, 32 million tonnes in the Advanced Countries and 32 million tonnes in the Rest of the Developing World.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2020 by World Steel Dynamics Inc. all rights reserved