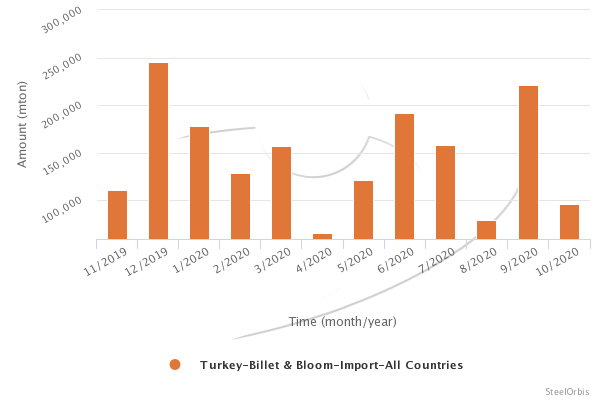

In October this year, Turkey's billet and bloom import volume decreased by 56.6 percent month on month to 95,858 mt, up by 36.7 percent year on year, according to the data provided by the Turkish Statistical Institute (TUIK). The value of these imports totaled $46.58 million, decreasing by 50.1 percent month on month and up by 38.8 percent year on year.

In the January-October period of this year, Turkey's billet import volume amounted to 1.4 million mt, increasing by 10.2 percent, while the value of these imports decreased by 4.0 percent to $598.24 million, both year on year.

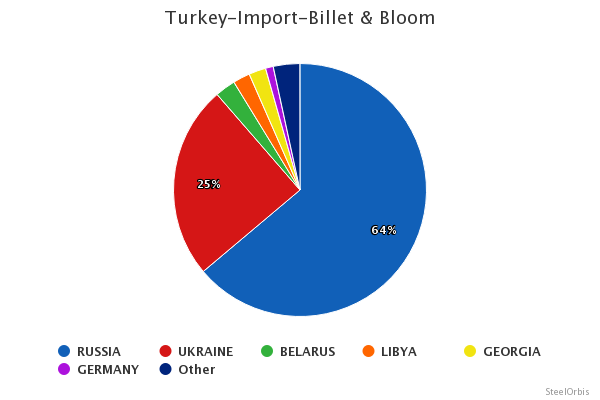

In the given period, Turkey imported 891,991 mt of billet and bloom from Russia, up 14.15 percent year on year, with Russia ranking as Turkey's leading billet and bloom import source, ahead of Ukraine which supplied 345,919 mt in the given period.

Turkey's top billet and bloom import sources in January-October are as follows:

|

Country |

Amount (mt) |

|

|

|

|

|

|

|

January-October 2020 |

January-October 2019 |

Y-o-y change (%) |

October 2020 |

October 2019 |

Y-o-y change (%) |

|

Russia |

891,991 |

781,389 |

14.15 |

71,181 |

46,593 |

52.77 |

|

Ukraine |

345,919 |

303,400 |

14.01 |

13,974 |

17,424 |

-19.80 |

|

Belarus |

36,465 |

20,386 |

78.87 |

- |

- |

- |

|

Libya |

30,628 |

- |

- |

- |

- |

- |

|

Georgia |

30,412 |

65,547 |

-53.60 |

4,010 |

3,809 |

5.28 |

|

Germany |

13,833 |

14,681 |

-5.78 |

1,207 |

1,308 |

-7.72 |

Turkey's main billet and bloom sources on country basis in the January-October period of this year are presented below: