The CIS steel industry is expected to stabilize in 2010, due to a forecasted slow recovery in steel volumes and stabilization in prices, the leading global ratings agency Fitch Ratings has stated in its report entitled, "2010 CIS Steel Outlook: Performance to Stabilize; Outlook Remains Challenging."

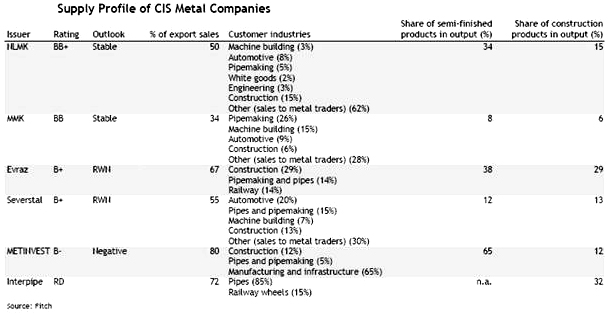

The 2010 industry outlook for Russian steel companies is stable due to the expected stabilization of steel prices in Q3 2009-Q4 2009 and the expected slow recovery in steel volumes. However, the credit outlook for Russia's Fitch-rated steel producers remains challenged due to the low profitability of producers' overseas operations, substantial leverage and liquidity constraints for some issuers.

Meanwhile, in Ukraine, the recovery of steel industry players is likely to take longer than in Russia, given significant foreign-currency debt, constrained liquidity at some issuers and the higher risk of default, Fitch states. The outlook for the Ukrainian steel producers remains negative due to the economic downturn in Ukraine and producers' heavy export orientation.

Fitch estimates that real domestic steel demand in the CIS will grow by 3-6 percent in 2010, compared with 4-7 percent in Russia and 2-3 percent in Ukraine. "Infrastructure projects, the maintenance of existing oil and gas pipelines and the construction of new oil and gas pipelines will continue to be the major drivers of domestic steel demand growth," Sergei Grishunin, director in Fitch's Corporates team, says. "However, domestic demand from general manufacturing and construction may grow only 2-4 percent, reflecting the difficult financial position of the respective industries, and within the construction sector, the lack of new projects in particular," added Mr. Grishunin.

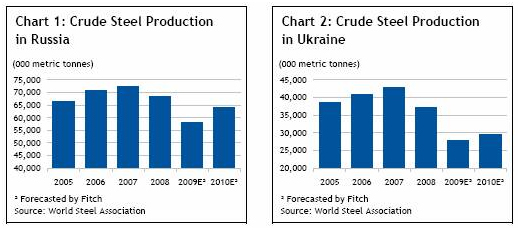

Fitch notes that de-stocking in some markets and sectors still continues, which may result in the growth of apparent steel demand (i.e., adjusted on the level of traders' stocks) by 7-9 percent in domestic markets in 2010, and even higher growth in apparent demand (10-12 percent) in key export markets. Following this increases, the 2010 output of CIS steel producers is expected to increase by 8-10 percent year on year in Russia, and by 5-7 percent in Ukraine.

According to Fitch's forecasting, in 2010, due to the significant decline in output of the domestic metal consuming industries in 2009, the CIS steel companies will remain export-oriented: exports make up 75-85 percent of Ukrainian producers' sales and 50-60 percent of Russian producers' sales. Asian countries will remain the key export destination for producers, but the share of sales to Europe and the US will grow as these markets recover from the downturn. The agency notes that sales of construction products to Middle East countries may decrease due to the ongoing financial difficulties in key consuming countries (such as Dubai).

Steel prices are anticipated to stabilize in 2010 at the levels achieved in Q3 2009-Q4 2009 with possible growth, albeit small, in the summer months due to a seasonal increase in demand from the construction industry. Domestic prices within the CIS are expected to be 10-20 percent higher than export prices due to export-import parity and the ongoing appreciation of the Russian ruble. Fitch notes that if production capacity overtakes the growth in demand, then steel prices may fall.

Fitch's overall modeling assumption is that in 2010 CIS steel producers' revenue will grow by 3-15 percent, while their EBITDAR will be in the range of 11-27 percent.