As of late last week, US domestic flats mills had not yet been able to gain acceptance of their pre-Labor Day $40/nt price increase announcement, although US domestic HSS buyers are reporting that tubing mills have had been more successful in garnering upward pricing momentum, with a strong belief that another increase announcement is just around the corner.

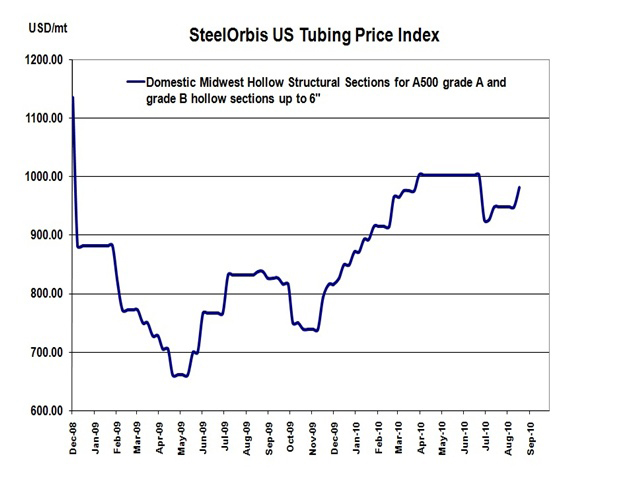

Currently, HSS spot offers are being reported at approximately $44.00-$45.00 cwt. ($970-$992/mt or $880-$900/nt) ex-Midwest, and $48.00-$49.00 cwt. ($1,058-$1,080/mt or $960-$980/nt), ex-West Coast, meaning transaction ranges have officially reached current mill asking prices.

This is especially good news for Midwest producers, who have been making a strong push toward pricing recovery after falling to an approximate range of $41.50-$42.50 cwt. ($915- $937/mt or $830-$850/nt) at the end of July. But while pricing momentum has begun to swing in a more positive direction, this isn't to say that there aren't some deals being made for larger orders. They are, however, becoming fewer and farther between.

Consistent with our last HSS analysis two weeks ago, a number of purchasing managers are continuing to report a certain level of frustration, with the validity of an increase for HSS made on the heels of hot rolled coil (HRC) increase announcements being strongly questioned- especially because the newly published ranges for HRC are being accepted extremely slowly, if at all.

"The tubing mills are going to use any excuses they can to raise their prices," said one Midwest buyer. "It doesn't matter if the actual transaction ranges for HRC hasn't moved."

In terms of demand, order activity is still, for the most part "not where it ought to be", and that mills are continuing to fight over business. And considering that it's being reported that stronger inventory positions were taken in mid-August, in the time period surrounding the first HSS increase announcement, already bland order activity may be seen trending even more bland due to end-users not buying as much, or as quickly, as they used to.

For now, the forecast for HSS will be neutral to slightly upward, with another $40-$60/nt increase announcement by ex-Midwest mills expected to emerge in the very near future, quite possibly by as soon as the end of this week.

Shifting focus to imports, Turkish offers continue to be reported at $43.00-$44.00 cwt. ($948-$970/mt or $860-$880/nt) FOB Gulf Port. However, with the end of the year rapidly approaching, very few, if any, traders are making buys on shipments that won't arrive until mid to late December.