The US domestic hollow structural section (HSS) market has trended strongly downward since our last report two weeks ago, closely mirroring the pricing trend experienced in the precarious hot rolled coil (HRC) market over the past few weeks.

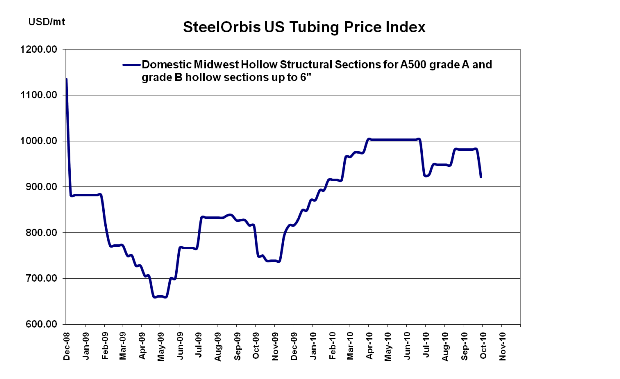

Domestic spot prices have come down approximately $3.00 cwt.($66/mt or $60/nt) since our last report and are now being reported at approximately $41.00-$43.00 cwt. ($904-$948/mt or $820-$860/nt) ex-Midwest mill, and $45.00-$46.00 cwt. ($992-1,014/mt or $900-$920/nt) delivered ex- West Coast; isolated transactions, have however been recorded above and below the reported ranges depending on order specs and tonnage size.

Mills are still at excess capacity for the current demand rates, and are desperate for meager orders right now, explained one Midwest buyer, but due to fragile HRC prices, a weak period seasonally, and sporadic booking activity they have no choice but to "stagger until the end of the month."

Where prices will actually go by the end of Q4 continues to be debated however, with some expecting spot prices to rise slightly as the year comes to a close and the market "tightens up," and others afraid that if HRC hits below $26.00 cwt.($573/mt or $520/nt), the HSS market could see another official decrease before the end of the year. "Expect the unexpected" said one buyer in the South.

As for imports, buyers continue to have very little interest; however, Turkish offerings persist at around $38.50-$39.50 cwt. ($849-$871/mt or $770-$790 /nt) duty-paid, FOB loaded truck in Gulf ports. However, on the inventory side, imports continue arriving to the US at a steady pace. Preliminary license data from the US Steel Import Monitoring and Analysis System (SIMA) demonstrate that total import tonnage of structural pipe and tube was 25,383 mt in September, down only slightly from 26,514 mt (census data) imported in August, and up significantly from the 17,406 mt imported in September of last year. As of October 26, structural pipe and tube arrivals to the US in October amount to 18,241 mt (License data).