As mills begin to collect on their late January-announced $4.00 cwt. ($88/mt or $80/nt) increase, buyers are on edge as another price hike lurks around the corner.

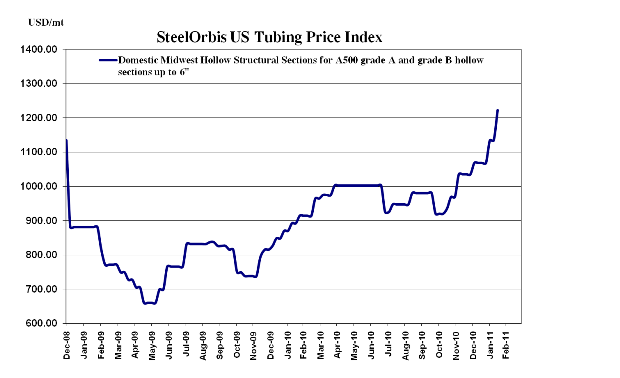

US domestic spot prices for hollow structural sections (HSS) are now in the range of $54.00-$57.00 cwt. ($1,190-$1,257/mt or $1,080-$1,140/nt) ex-Midwest mill with the lower end only available for large tonnage buyers, and most transactions being placed around $56.00 cwt. ($1,235/mt or $1,120/nt). Current spot prices are up $4.00 cwt. since late January and are only expected to increase further. HSS producers, which have been largely mirroring the price hikes in hot rolled coil (HRC), are expected to issue another increase anywhere from $1.50-$2.50 cwt. ($33-$55/mt or $30-$50/nt) to match the latest flat-rolled increase at the end of January (excluding AK Steel's February 10-announced $50/nt increase).

While the manufacturing and energy sectors appear to be improving, the fabrication sector-what many distributors cite as their biggest customer-continues to struggle. Distributors informed SteelOrbis that end-users are balking at higher- prices forcing them (distributors) to sell what they have in stock for below the replacement cost at today's prices.

On the West Coast, spot prices have increased $4.00 cwt. as well, and the most commonly reported spot ranges are now $56.00-$57.00 cwt. ($1,235-1,257/mt or $1,120-$1,140/nt) ex-mill, but although prices continue to rise, demand remains relatively stagnant. Everything is on a buy-as-you-need basis and little, if any, purchasing is being made for inventory replenishment.

The biggest concern now is that because higher prices have not been a reflection of real demand, the continuous increases in raw steel production levels (which were up another 1.1 percent last week, while capacity utilization rates rose to 74.8 percent) could put the market dangerously close to overproduction in the not-so-distant future, causing prices to tumble.

There is no confidence in the sustainability of current prices in the US market, which leaves little room for import activity. Turkish offers of tubing products to the US have increased approximately $8.00 cwt. ($176/mr or $160/nt) to $51.00-$53.00 cwt. ($1,124-$1,168/mt or $1,020-$1,060/nt) duty-paid FOB loaded truck in US Gulf ports since the last offers were heard in mid-to-late January, all but solidifying a slowdown in inquiries for the time being.