Due to many in the steel industry taking time off before and after the US Independence Day holiday on July 4 this week, the US domestic and import energy pipe market has been quiet.

Domestically in the US, spot prices for J55 electric resistance welded (ERW) OCTG casing and API X42 ERW line pipe have stayed in the range of $66.00-$67.00 cwt. ($1,455-$1,477/mt or $1,320-$1,340/nt) ex-mill since last week on what has been little activity. But even with the pre- and post-holiday slowdown, early indications are pointing to a slight strengthening in US domestic OCTG prices, especially with US rotary rig counts still rising (up four last week and up 22 the week before). Domestic line pipe prices, on the other hand, are still soft as a result of some waning demand levels, and are likely to dip as the summer progresses.

The holiday slowdown has affected the import market as well, with activity minimal and import offer prices remaining unchanged. Korean and Taiwanese API X42 ERW line pipe prices are still $49.00-$50.00 cwt. ($1,080-$1,102/mt or $980-$1,000/nt) DDP loaded truck in US Gulf ports. As for Korean and Taiwanese J55 ERW OCTG casing, offer prices have also reflected no change since last week and still range from $53.50-$54.50 cwt. ($1,179-$1,202/mt or $1,070-$1,090/nt) DDP loaded truck in US Gulf ports. Import prices in the US continue to be under downward pressure, however, with most US-buyers waiting for the direction of US domestic prices to become clearer before placing an order offshore.

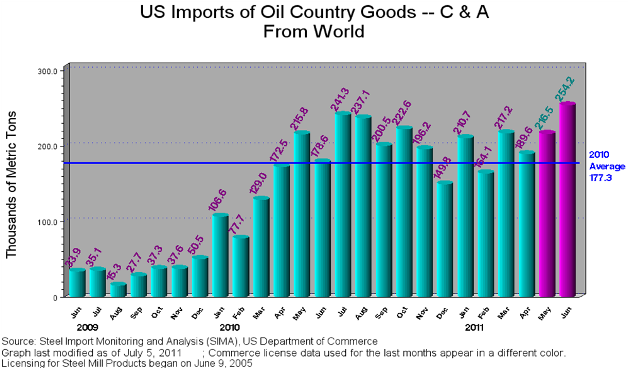

Meanwhile, orders placed offshore in mid- to late-Q1 are arriving into the US at high levels. According to the latest data from the US Steel Import Monitoring and Analysis System (SIMA), the US imported 178,011 mt of line pipe in June compared to 143,885 mt imported in May. The main source of imported line pipe in the US in June was Korea, which exported 59,898 mt of line pipe to the US last month compared to 30,833 mt in May. Other notable sources of line pipe in June were Russia (15,232 mt compared to 5,263 mt in May), Taiwan (6,955 mt compared to 1,512 mt in May) and China, which exported 9,174 mt of line pipe to the US in June compared to just 671.9 mt in May. Korea was the primary source of imported oil country goods in the US in June as well, exporting 73,896 mt compared to 22,654 mt in May. Total US arriving imports of oil country goods climbed in June to 254,396 mt compared to 215,936 mt in May, reaching the highest level in over two years.