With the tight scrap supply, increasing domestic demand and escalating export scrap prices, US scrap prices are expected to have another significant increase in the beginning of April.

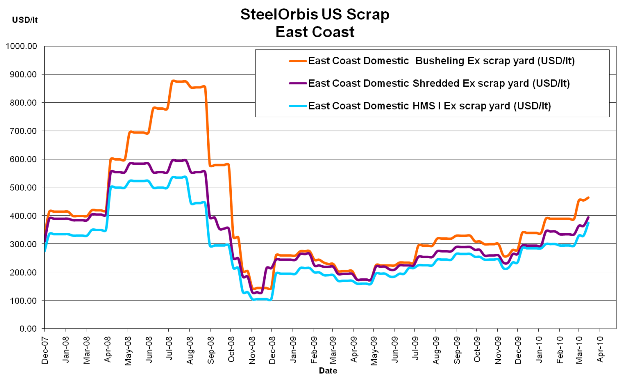

The US scrap market keeps strengthening in March. When comparing the current prices to those from two weeks ago, East Coast busheling prices have already gone up approximately $10/lt ($9.84/mt), shredded scrap prices have increased approximately $30/lt ($29.53/mt) and HMS I prices have raised about $45/lt ($44.29/mt). Currently, East Coast prices for busheling are in the level of $460 to $470/lt ($452.74 to $462.58/mt), shredded scrap prices stand at $390 to $400/lt ($383.84 to $393.68/mt), and HMS I prices range between $370 and $380/lt ($364.16 to $374/mt). In April, market sources expect US cut grade scrap prices to go up another $30 to $40/lt ($29.53 to $39.37/mt), and some optimistic market insiders expect prime grade scrap to increase $50 to $80/lt ($49.21 to $78.74/mt).

With the low scrap inventory level from the domestic mills, increasing auto production from the integrated mills and continuous tight scrap supply, the domestic scrap market is getting stronger. Moreover, the rainy weather on the East Coast in New York and Pennsylvania delayed scrap shipments. In order to continue the gradually increasing steel production, domestic mills will need to keep on buying scrap in April, and therefore domestic scrap prices are expected to go up again next month.

On the other hand, US scrap export prices are escalating due to increasing demand from the European and Middle East markets and their own lack of scrap supply, and that has put pressure on the US scrap prices as well.

However, some producers are concerned that the US scrap market is heading into a repeat trend of 2008, the year that US busheling scrap prices hit a peak in the high $800's/lt in July . As spring weather approaches, scrap flow will improve with easier scrap collection and transportation, so steel producers are hoping to see the price drop or stabilize soon when the scrap supply loosens. But due to the lack of overall scrap supply with the ever-increasing global demand for scrap, steel producers may be disappointed if the scrap prices keep rising.

The latest USITC data show that the total amount of ferrous scrap exports from the US in January was 689,000 mt, which represents a decrease of 875,000 mt when compared to the figure of 1,564,000 mt in December 2009 and also reflects the lowest export amount since April 2007.

The main recipients of shredded scrap from the US in January were: China, at 124,000 mt; Mexico, at 64,000 mt; Turkey, at 33,000 mt; Taiwan and Greece, at 27,000 mt each; South Korea, at 18,000 mt; and India, at 14,000 mt. Countries that imported smaller amounts of shredded scrap from US during the month include Canada, Pakistan, and Italy.

For HMS I grade scrap, the top recipients of US exports in January were: South Korea, at 66,000 mt; Taiwan, at 48,000 mt; Turkey, at 30,000 mt; Egypt, at 24,000 mt; and India, at 18,000 mt. Italy, China, Mexico and Canada imported some tonnage of HMS I grade scrap from the US during the month as well.