In the Turkish domestic wire rod market, the price increases seen since early this week have caused buyers to become anxious. These price increases have resulted in longer times for calculation of final product (steel mesh, nail) production costs and for the reflection of increased costs on to final product buyers. This has raised the concerns of wire rod buyers. In the meantime, shortages in the supply of certain sizes of wire rod cause problems for wire rod buyers in terms of their final product orders.

SteelOrbis has learned from market sources that a major steel producer in Turkey's Iskenderun region has decided to postpone planned maintenance works at its wire rod production line from early June to mid-June, due to intensive demand and high prices. Although the wire rod price gap between the different regions now seems to have narrowed ($755-775/mt), wire rod sales from Turkey's other regions to the Iskenderun region still continue. The US dollar/Turkish lira exchange rate has lately reached 1.60 and above levels and this has contributed to the narrowing of price differences.

In the meantime, the depreciation of the euro against the US dollar (from 1.49 to 1.41) has provided some relief as regards wire rod exports from Europe to Turkey. However, when lead times are involved, Turkish buyers are cautious in their approach to exports. For example, mesh quality wire rod offers given from Greece are at €525-530/mt ($744-751$/mt) FOB. However, considering the freight rates and lead times, the Turkish domestic market is more attractive for buyers.

On the other hand, China is still following an aggressive policy in its boron-added wire rod exports. SteelOrbis has learned that ex-China offers to India at $755-760/mt CFR for late June shipments have failed to attract the attention of Indian buyers.

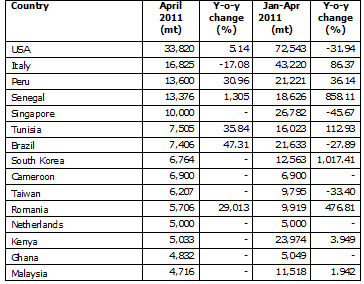

Turkey's major wire rod export markets are as follows:

Source: Turkish Mining and Metals Exporters Association (IMMIB)

In May, along with these major export markets, the West and Central African markets are forecast to stand out among Turkish mills' key wire rod markets. In the meantime, following the weakening of the euro against the US dollar (to 1.41), Turkey's wire rod exports to Italy are seen to slow down.

On the other hand, the Nigerian market is expected to become pick up as an export market for Turkish mills in the coming days. Following the Nigerian parliament's consideration of revised 2011 budget of $28.09 billion, the demand increase in the country may accelerate in June.