Silence from overseas and rumblings south of the border have helped the US wire rod market stabilize into a comfortably neutral trend.

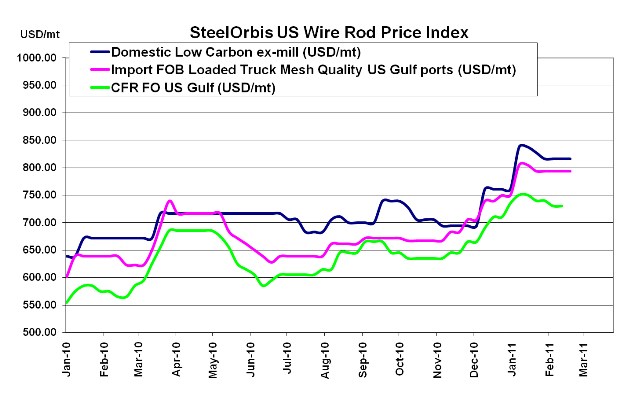

Even though the domestic wire rod market was under pressure last week, with mills encountering difficulty firming up February prices, the current import situation has relieved some of the pressure. Overseas, Turkish mills, seeking to maintain firm offers to the US, have shrugged off inquiries from US traders in the $730-$735/mt CFR range. As such, sales prices in the US have not changed in the last week, but there doesn't seem to be many takers for prices in the range of $35.50-$36.50 cwt. ($783-$805/mt or $710-$730/nt) duty paid FOB loaded truck in US Gulf ports.

South of the border, the anti-dumping situation discussed in last week's report is already affecting the US market, even though nothing has been officially decided by the US Department of Commerce. According to sources, the disputed 4.75 mm diameter Mexican rod makes up 10 percent of the domestic market, and US buyers are already preparing to source that material elsewhere. Domestic mills have reported an increase in inquiries, which has helped them not only stave off the spot pricing slide, but expect a firming in spot prices in the near future.

Currently, official mill asking prices for US domestic wire rod are in the range of $39.25-$40.25 cwt. ($865-$887/mt or $785-$805/nt) ex-Midwest mill, with spot prices generally about $3.25 cwt. ($72/mt or $65/nt) less. And although scrap predictions for March are still pointing to a sideways to slightly downward trend, it is becoming unlikely that US mills will adjust asking prices for April shipments, even if scrap prices drop-sources tell SteelOrbis that mills are in no mood to give up any gains they've won over the past few months. Additionally, domestic demand is decent enough to support such a move.