In light of low purchasing volume and meager demand, there hasn't been a significant impact in the domestic wide flange beam (WFB) market after mills announced a $25/nt ($1.25 cwt. or $28/mt) decrease in transaction prices.

Although one of the price announcements (from Nucor-Yamato) explicitly stated that the immediate decrease was "in response to a domestic competitor's rebates", many in the beam market see the move as more of a price adjustment to reflect actual spot prices; some service centers have been selling beams for at or below mill asking prices lately, indicating that listed prices are not very firm. Early in the spring, mills tried to raise their prices ahead of the traditional inventory restocking for the spring construction season, but purchasing activity was more lackluster than anticipated, and many beam buyers turned their attention toward imports. However, service centers are generally operating on a "hand-to-mouth" basis, so aside from some offshore offers they can't refuse, they are, for the time being, sticking mostly to domestics for small quantities delivered quickly.

Currently, import offers of WFB are about 10 percent less than domestic prices, with most beams coming from Europe and the Far East. According to the latest import data from the US Import Monitoring and Analysis System (SIMA), the US imported 8,791 metric tons (mt) of beams from Korea in May, and June levels (with a week to go in the month) are at 5,283 mt. Luxembourg, traditionally the US' second largest importer, was the source of 3,416 mt of beams in May and 2,018 mt so far in June. A surprising source of beams in May was South Africa, which brought in 3,099 mt, compared to a previous string of single-digit levels. Overall, the US imported 21,534 mt of WFB in May, only 43 mt above April levels. However, June levels are already looking slim, with 9,127 mt imported so far. If import levels continue to decline, it might quash a rumor floating around that some domestic mills are looking to file anti-dumping (AD) suits against ArcelorMittal, whose large volume of imports may or may not be proven to be "injurious" to the domestic market.

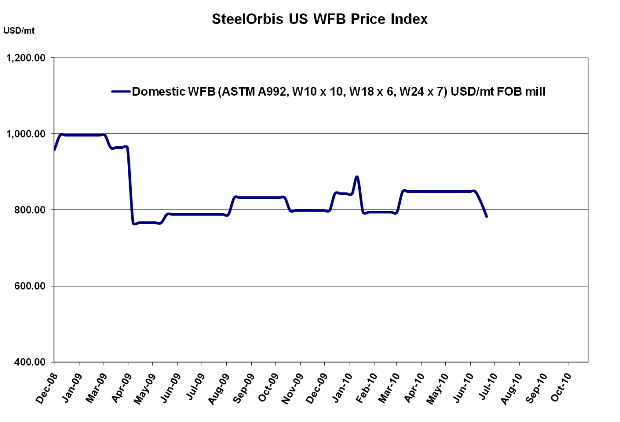

Regardless of the import situation, domestic mills are dependent on domestic demand, and if there is no discernable increase in the near-term, mills might continue to cut quiet deals with service centers, which saw a drop in monthly shipments during May. According to the latest MSCI Metals Activity Report, monthly shipments fell from 225,800 nt in April to 201,200 nt in May. Also, inventory levels rose month-on-month, from 518,600 nt in April to 531,900 nt in May. Due to higher inventory levels, service centers are not desperate for product and are in a better position to negotiate with mills. Currently, domestic prices for WFB are listed at $37.25 cwt. ($821/mt or $745/nt) ex-mill for ASTM A992, W10 x 10, W18 x 6, and W24 x 7, but actual spot offers might still fall slightly underneath.

It is widely known that WFB demand from the US construction sector is less than spectacular, but conflicting reports abound as to any sort of accurate picture of the current situation as well as forecasts for the future. For instance, McGraw-Hill Construction recently reported a 3 percent month-on-month rise in new construction activity in May, including a 1 percent gain in residential construction and a 19 percent increase in non-residential construction. However, while the overall US unemployment rate dipped slightly in May (by 0.2 percentage points), the construction sector saw a loss of approximately 35,000 jobs. It is hard to reconcile such statistics, and even Robert A. Murray, Vice President of economic affairs for McGraw-Hill, offered a mix of uncertainty and optimism in the company's press release:

"The recent pattern of construction starts indicates that activity has stabilized at a low level, with ups-and-downs on a monthly basis, but the transition to sustained expansion has yet to occur," said Murray. "The good news with the May statistics is that nonresidential building rebounded after a very depressed April. However, the volume of nonresidential building remains quite low, and is likely to stay that way through 2010. Much of this year's upward movement is expected to come from public works construction, which lost momentum in May after earlier gains."