Low inventories and high raw material costs have stimulated purchasing activity and bolstered price increases in the US rebar market.

Seasonal scrap shortages, leading to higher prices, are nothing new in the steel industry. But this year, with unpredictable late summer-early fall scrap prices and uncertainty regarding end-use demand, many domestic rebar buyers ran down their inventories, especially in states that tax end-of-year stock, such as Texas. Now that scrap pricing seems to be on a long-ranging hot streak (current predictions indicate an approximate $40/long ton increase for shredded in January), rebar distributors have no choice but to buy at rapidly increasing prices.

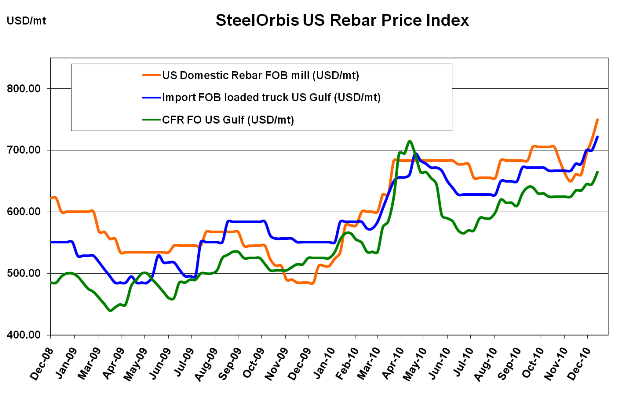

Currently, SteelOrbis has learned that there's very little chance of getting domestic rebar for under $34.00 cwt. ($750/mt or $680/nt) ex-mill, reflecting a significant change from last week's spot prices of $32.00-$33.00 cwt. ($705-$728/mt or $640-$660/nt) ex-mill. Official mill asking prices for January shipments, including last week's $2.25 cwt. ($50/mt or $45/nt) increase, are now in the range of $35.00-$35.50 cwt. ($772-$783/mt or $700-$710/nt) ex-mill, with a strong expectation that mills will get their full asking prices even before scrap pricing is announced next month.

A side effect of domestic rebar's upward momentum is a renewed competitiveness with import offers. Rebar prices from Turkey have also increased, but not by nearly as much. Currently, Turkish rebar offers are in the range of $32.25-$33.25 cwt. ($711-$733/mt or $645-$665/nt) duty paid FOB loaded truck in US Gulf ports, reflecting an increase of $1.00 cwt. ($22/mt or $20/nt) from last week. Traders are reporting a substantial increase in rebar orders--quite a contrast from a few weeks ago when, according to one trader, "we were struggling to sell at $27.00 cwt. ($595/mt or $540/nt)."

South of the border, Mexican mills, which indicated that rebar prices would follow US price increases, are now offering in the range of $32.00-$33.00 cwt. ($705-$728/mt or $640-$660/nt) duty paid FOB delivered to US border states, reflecting a $2.25 cwt. increase from last week. Some deals have been heard as low as $31.50 cwt. ($694/mt or $630/nt), but those offers will likely dry up as the end of the year approaches.