Both domestic and import prices for rebar have remained neutral in the last week, as the market awaits a likely spike in scrap prices soon.

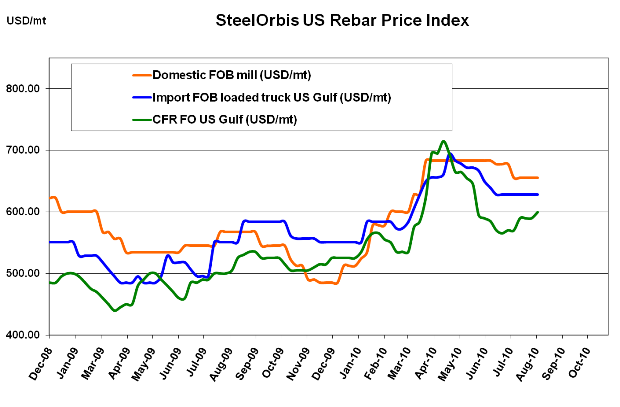

While some spot deals slightly under asking prices have been concluded in the US rebar market, they are getting less frequent and more restrictive, as mills are in no mood to cut prices with a scrap increase looming. Current projections are for shredded scrap prices to go up by $20-$30/long ton, which might not necessarily bump up rebar prices, but the increase would likely bring transactions closer to mill asking prices. For now, domestic rebar is still being offered in the general range of $29.50 cwt. to $30.00 cwt. ($650/mt to $661/mt or $590/nt to $600/nt) ex-mill, with spot offers for interesting orders heard at about $0.50 cwt. ($11/mt or $10/nt) less.

South of the border, Mexican mills have kept their rebar offers stable. Although the local Mexican market is weak, mills are preferring to cut deals for imports, and consequently, import orders have increased. Current import offers for Mexican rebar are still in the range of $26.50 cwt. to $27.50 cwt. ($617/mt to $639/mt or $560/nt to $580/nt) delivered to US border states, but Mexican mills, like their US counterparts, might stave the flow of dealmaking if scrap indeed increases this month.

Overseas, Turkish rebar pricing has gone up locally on the heels of scrap increases, but purchase prices in the US have not been affected, namely because accepted offers are few and far between. With current asking prices at $28.00 cwt. to $29.00 cwt. ($617/mt to $639/mt or $560/nt to $580/nt) FOB duty-paid loaded truck in US Gulf ports-unattractively close to US prices-the only customers entertaining the idea of Turkish imports are those prohibitively far from the Mexican border, or those in no desperate need for deliveries in the next six to eight weeks.