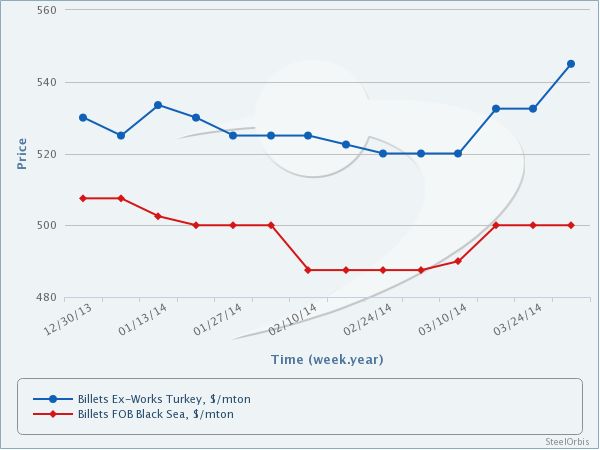

According to market sources, the Turkish domestic billet market faces serious availability shortages. Local prices have moved up by $10-20/mt since last week to $535-555/mt ex-works. Meanwhile, a steel producer in the Iskenderun region will not be able to provide billet before May, causing other producers to raise their prices.

On the other hand, CIS billet offers to Turkey are at $515-530/mt CFR, indicating an increase of $10/mt over the same period, while local buyers' demand for import billet will likely improve in the coming days due to the current availability shortages.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.