Although the recent $60/nt price increase shocked US wire rod buyers, they are coming to terms with the reality that the market's strong upward trend shows no signs of slowing.

Last week's $3.00 cwt. ($66/mt or $60/nt) price increase announced by domestic wire rod mills took customers by surprise at first, but as December bookings filled up and lower-end spot deals dried up, it became apparent that wire rod's uptrend was not a temporary phenomenon. Many in the wire rod market, especially drawers, purposely ran down inventories ahead of the end of the year--but the significant jump in shredded scrap pricing this month, plus a near-assurance of another substantial hike next month, has convinced many buyers to get off the fence and book orders.

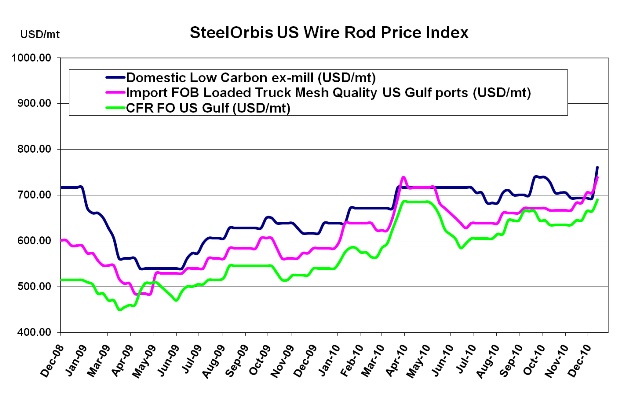

Because current bookings are for January shipments, mill asking prices for wire rod are now in the range of $35.50-$36.50 cwt. ($783-$805/mt or $710-$730/nt) ex-mill, with most spot prices in the $34.00-$35.00 cwt. ($750-$772/mt or $680-$700/nt) ex-mill range. Some deals have been reported as low as $33.50 cwt. ($739/mt or $670/nt) ex-mill, but there is nothing anywhere near last week's common spot price of $31.50 cwt. ($694/mt or $630/nt) ex-mill. Even though customers are clamoring for orders before another price increase is announced in January, the fervent purchasing activity is not necessarily based on demand--mainly raw materials and stock levels. This has led many to describe the current situation as another bubble, likely to burst sometime in Q1 2011. However, this will depend greatly on the following spring construction season--if demand near the end of the first quarter seems sustainable, price increases might sustain as well.

Import offers have followed the domestic trend and increased in the last week, by about $1.50 cwt. ($33/mt or $30/nt), bringing most Turkish offers into the range of $33.00-$34.00 cwt. ($728-$750/mt or $660-$680/nt) duty paid FOB loaded truck in US Gulf ports, with some deals into the Gulf reported as low as $32.50 cwt. ($717/mt or $650/nt). US-based traders have told SteelOrbis that import bookings have not increased substantially quite yet, but that might change if US spot prices firm up even further.