As expected, domestic rebar mills offset lower scrap costs with a base price increase, bringing much needed stability to the market.

Last week, spot prices for rebar were heard to be firming up in the US, and mills were finally starting to see most of the $1.00 cwt. ($22/mt or $20/nt) price increase announced in mid-September. Customers' willingness to pay near-asking prices, along with steady purchasing activity, led mills to offset the $1.50 cwt. ($33/mt or $30/nt) decrease in their raw materials surcharge (RMS) this month with a base price increase of the same amount, effective immediately. Now that prices are neutral for the next 30 days or so, most rebar distributors are optimistic about the stability the move will bring to the market.

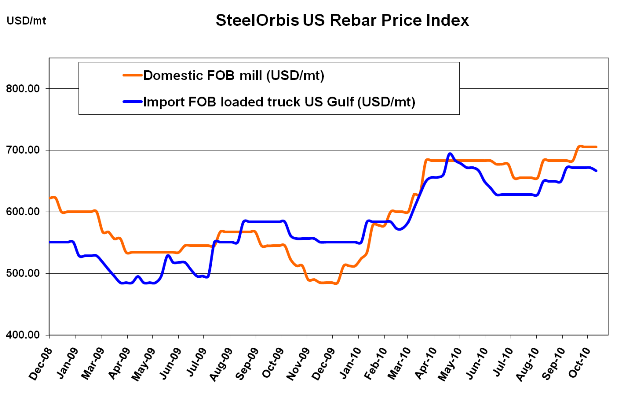

However, there are some concerns. Because mills chose to keep prices level, there is a $1.50 cwt. cushion from the scrap decrease that they can use to cut deals if they want. One East Coast distributor expressed his fear that mills might "get aggressive with their price-cutting for individual customers," which could throw the currently stable rebar prices out of alignment. For now, average transaction prices are still in the approximate official asking range of $31.75-$32.25 cwt. ($700-$711/mt or $635-$645/nt) ex-mill, but that could change in the next couple weeks.

As for imports, activity is relatively slow, especially from overseas. Turkish rebar is suffering the same effect of current currency conditions as other steel products from the region-the US dollar is weak against both the euro and the Turkish lira, which has discouraged Turkish mills from lowering prices to levels that would be attractive to US buyers. Current offers have declined slightly, by about $0.25 cwt. ($5.50/mt or $5/nt), but even so, the new range of $29.75-$30.75 cwt. ($656-$678/mt or $595-$615/nt) duty paid FOB loaded truck in US Gulf ports is not garnering many orders.

Across the border, Mexican mills were waiting for US mill announcements before making their own decision on rebar pricing, but as of press time, nothing official has been released. Although Mexican mills quietly raised import rebar offers to the US by about $1.00 cwt. near the end of September, the increase didn't stick and most transaction prices are already back in the $28.50-$29.50 cwt. range ($628-$650/mt or $570-$590/nt) duty paid FOB delivered to US border states. Mexican mills will probably not drop prices further than that range in reaction to US mills' neutral move, but they will still most likely offer discounts to large orders for slightly less.