Almost three weeks after shredded scrap pricing dropped $30/long ton, lower prices have finally emerged in the domestic wire rod market.

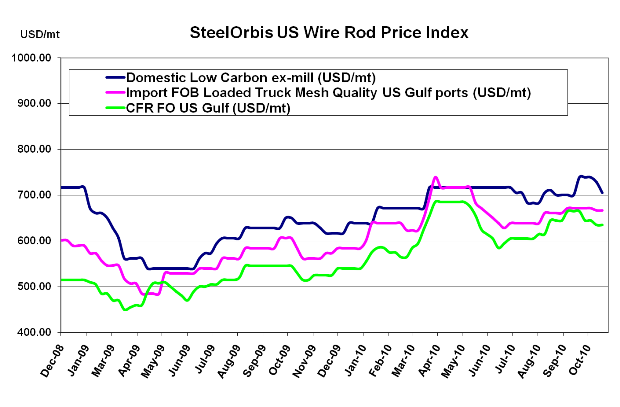

The general consensus in the last few weeks was that mills would drop prices by up to $1.50 cwt. ($33/mt or $30/nt). However, current prices heard in the market have not dipped so considerably. Mills have not made any official declarations, quiet as they usually are, and are offering wire rod for about $31.50-$32.50 cwt. ($694-$717/mt or $630-$650/nt) ex-mill, which is about $1.00 cwt. ($22/mt or $20/nt) less than the previous "official" range. Certain isolated transactions have been heard of outside the lower end of that range, and it remains to be seen if mills will drop prices further.

At least until November scrap pricing becomes clear, the trend for US wire rod prices is decidedly down, especially because demand is also softening for anything construction-related. It is widely believed that most of the stimulus money that was promised to the construction industry did not flow to the sectors that needed it most, and the forecast for 2011 is not exactly sunny. Already, building permits dropped 5.6 percent in September form August, according to the US Census Bureau, and housing starts only increased by a meager 0.3 percent month-on-month.

Normally, weak demand and falling domestic prices would have a similar impact on import offers, however, wire rod offers from overseas are experiencing an opposite trend. While prices have not officially increased from Turkey, there is speculation that as of next week, import offers will rise slightly based on higher scrap costs to Turkish mills. Currently, import wire rod prices are still in last week's range of $29.75-$30.75 cwt. ($656-$678/mt or $595-$615/nt) duty paid FOB loaded truck in US Gulf ports. But considering that there have been hardly any takers to such prices, import activity will likely drop even further if prices go up next week.