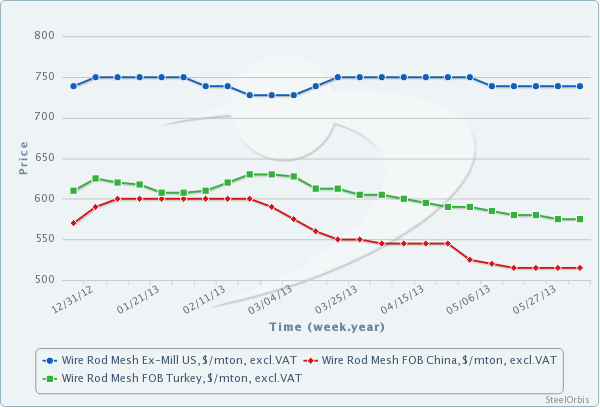

After dropping import wire rod offers to the US to drastically low levels, foreign mills apparently "woke up and smelled the coffee" and are attempting to lift prices back up, according to sources. Turkish wire rod offers in the US are likely to rise due to increasing scrap prices in the region, but rumblings of a price bump have not yet made their way into the US import market. For now, Turkish offers are still in the range of $30.00-$31.00 cwt. ($661-$683/mt or $600-$620/nt) DDP loaded truck in US Gulf ports, but that could change in the next week or so. Chinese mills, meanwhile, do not exactly have a raw materials-based reason to lift prices, but traders say that low bids have been repeatedly rejected in the last week, indicating that "a movement is afoot" to reverse the price trend. Traders are not sure yet how this will affect inquiries for Chinese wire rod--which remains the most attractive in the market in terms of price--as even a small increase to the current, unchanged offer price range of $28.25-$29.25 cwt. ($623-$645/mt or $565-$585/nt) DDP loaded truck in US Gulf ports will still be well below the competition.

On the domestic front, US wire rod spot prices have not changed in the last week and are not expected to move much in the near term--the scant decrease in shredded scrap prices this month was not enough to affect the wire rod price trend either way. For the most part, spots are still ranging from $33.00-$34.00 cwt. ($728-$750/mt or $660-$680/nt) ex-mill, although attempts to move most small to medium customers to the higher end of the range are ongoing, according to sources.