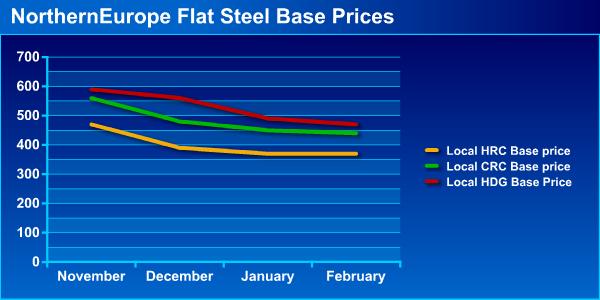

In the northern European flat steel market, the average base price of HRC have this week been at $370/mt, CRC base prices have been at €440/mt and HDG prices have this week been at €470/mt, all prices are excluding VAT and ex-works. In the time period between the first week of December 2008 and the first week of February 2009, the average base prices of HRC have declined by five percent, whereas CRC prices have declined by eight percent and HDG prices have fallen down by sixteen percent. In general, in the period in question, the overall flat steel prices in northern Europe have softened by 9.66 percent in average. It is observed that the hot rolled material prices have been on a more stable trend compared to cold rolled material since January 2009. Even, some European traders say that the HRC prices may increase by €10-15/mt in March. The main reason behind this expectation is as follows: With the price arrangements in December 2008, costs levels of HRC have already been reached. Additionally, it is observed that the sluggishness in white goods, construction, automotive, cooling systems and metal goods has affected cold rolled and galvanized material in particular and due to the affect in question, prices decreases have been observed in these products. The downtrend in question can be seen in the graphics below:

In the past, when the prices were increasing, steel distributors, stockists and steel service centers had expanded their customers -(i.e end users' positions) since they expected the prices to go up further. In addition, they kept their stocks at certain levels that created some cost and they managed their trade receivables i.e open accounts. It was normal in that time, when the prices were continuously increasing that distributors were providing funds (open accounts and 60 day deferred payments) as long as the production capacities and consumption were at high levels. Even, the material would be ready after the process before the deferred time is up. In addition to this picture, in those times, when the prices were increasing, risk insurance in Europe was widespread and taking the almost 70 percent of risk from distributors because nobody wanted to lose costumer. However, things have changed a bit recently. Although the market players have still been using the same instruments such as deferred payments or open accounts, it is now too difficult to manage all the abovementioned process since the banks are reluctant to share the risk now.

Now, it seems the honeymoon of stockists and end user is over due to the tightening in risk insurance market and due to the fact that banks are now more reluctant to insure the risks. Also, tightening in question has been a dynamo effect from the button to the top in the supply chain. It is observed that the medium and small scale end users are being affected by the current situation. Beside, stockists and distributors will be literally tested according to the risks that have not been proved by banks: Are these risks signs of danger or are they lost opportunities? Companies may lose their market share to their competitors while waiting for the banks. In order to manage this dilemma, companies should know their end-user customers in a better way and they should follow the market trends closer. There is great chance that some companies with managing their balance sheets better and with managing the abovementioned dilemma will be able increase their market share and will become strong in the current global financial crisis.

International Monetary Fund (IMF) IMF revised its forecasts, which previously announced in November 2008 and the fund reduced its previous forecasts for world economic growth to just 0.5 percent, down from a November estimate of 2.2 percent. The IMF also announced that the economies of developed countries will shrink by two percent this year, whereas the economies of developing countries' growth will be 3.3 percent. Meanwhile, it predicts that the Eurozone economy is to shrink by two percent in 2009 and the UK will see its economy shrink by 2.8 percent next year.

According to the Confederation of Iron and Steel Industries' (EUROFER) Economic Committee report, the EU's 27 member countries produced around 200 million mt of crude steel in 2008, according to figures from World Steel, making up for nearly fifteen percent of the global crude steel output. EUROFER have also announced that apparent consumption will drop by 29 percent year-on-year in the first quarter of 2009 and by a further 23 percent in the second quarter. It is reported that particularly the automotive sector is badly affected by the global recession, but also construction, steel tubes and the engineering sectors has been affected by downward trend.

Although it is expected that the flat steel prices in overall Europe may see a minor recovery once the destocking process will be finished, no permanent revival is being expected until late 2010. However, it should be note that the European markets are deeply related to the other markets such as the USA. Thus, the data comes from the USA i.e. consumer index data should be watched closely. It is expected that the first signal about the recession's end will come from these data. Certainly consumer did not start the recession; however, they may the one who finish it.

In general, it seems too early to make some comments about the effect of the economy packages and the central banks' reduction of interest announced by the EU countries to the steel market.