Despite mounting price pressures in the marketplace, US domestic plate prices are staying steady, along with domestic demand levels.

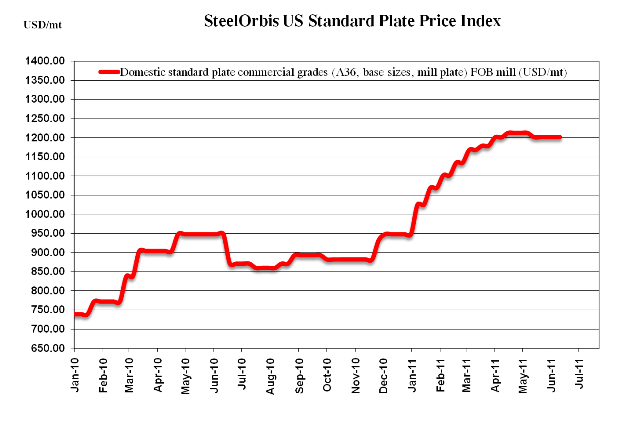

Domestic spot market prices for plate have been under pressure since US domestic flat-rolled spot prices began falling in the beginning of April. However, contained supply combined with consistent demand levels and little spot market material even available, has kept plate spot prices firm in the range of $54.00-$55.00 cwt. ($1,190-$1,213/mt or $1,080-$1,100/nt) ex-Midwest mill-reflecting no change from two weeks ago. The majority of spot transactions are being placed toward the lower end of the range, however, with a few offers heard just below.

But, since plate spot prices only saw minor softening last month in the face of softening domestic flat-rolled and slab prices over the last two months, most anticipate that plate prices won't decline much going forward, particularly because domestic demand for plate is showing few signs of slowing. Some typical "summer slowdown" softening is expected in July and August but nothing substantial, especially considering that supply will be somewhat curbed come September-one major mill has a maintenance outage planned for the month, which will take significant tonnage out of an already tight marketplace.

And so, offers from offshore for September and October delivery continue to be viable options for many US buyers. Even if US domestic plate prices falter in Q3, they aren't predicted to drop even close to current import offer levels. Both Russian and Turkish plate offer prices are in the range of $46.00-$47.00 cwt. ($1,014-$1,036/mt or $920-$940/nt) DDP loaded truck in US Gulf ports, a considerable $8.00 cwt. ($176/mt or $160/nt) below US domestic spot prices.

Due to strong import activity earlier this year, large numbers of imported plate have already arrived into the US. Data from the US Steel Import Monitoring and Analysis (SIMA) show that 73,376 mt (license data) of cut-to-length plate arrived into the US in May, compared to 69,602 mt (census data) imported in April. May imports were also the highest level of plate imports in the US in over a year.