The momentum in the US flat rolled market has continued since last week, with producers announcing additional price increases and spot offers for coated products moving up further.

This week, minimill flat rolled producer Severstal North America announced another price hike for hot dipped galvanized (HDG) coils and other flat rolled products, effective immediately, which is in addition to its previously announced $60/nt ($66/mt or $3.00 cwt.) price hike for January/February. This increase pushes the firm's HDG base prices up another $20/nt ($22/mt or $1.00 cwt.), making for a total $80/nt ($88/mt or $4.00 cwt.) hike since Thanksgiving, not including the new higher extras. Other producers are expected to follow suit with further price increases, taking advantage of the continuing positive momentum in the market.

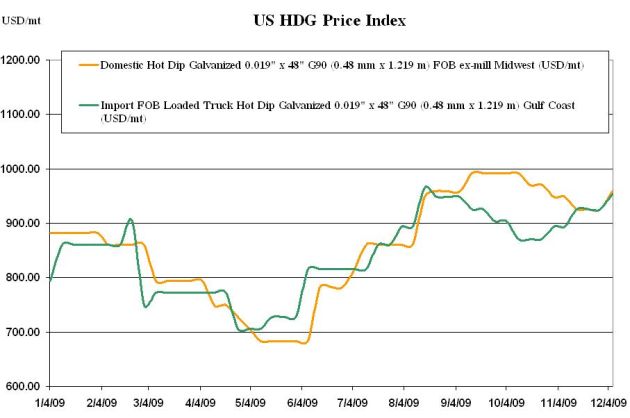

Domestic HDG spot offers are not quite at mills' desired levels yet, with offers of most products up by about $50/nt ($55/mt or $2.50 cwt.) since the beginning of the month. Still, mills appear confident that their announced price hikes will go through in full, as the market is still driven by low customer inventories and rising scrap prices. US mills are taking a disciplined production approach so as to maintain their pricing power, while imports are still largely out of the picture, as they are offered at uncompetitive levels with long lead times. Furthermore, many customers waited a little too long to buy, and are now anxious to secure some tons for Q1 and protect themselves from further domestic price increases. Along with a slightly positive demand outlook for the automotive sector, these factors are keeping the price trend for US flat rolled pointing upward.

US scrap prices are expected to rise even further in January, which will likely allow for at least one more price hike in this up-cycle. However, with the recovery of actual demand expected to be slow-going at best, some question whether the current up-trend in flat rolled pricing will be maintained beyond the first half of Q1.

Since last week, domestic base prices for HDG have risen by approximately $1.00 cwt., with most offers now ranging from $33.00 cwt. to $34.00 cwt. ($728/mt to $750/mt or $660/nt to $680/nt) ex-mill, Midwest. Offers of the most commonly produced domestic size and coating, 0.019" x 48" G90 (0.48 mm x 1.219 m), have similarly risen by $1.00 cwt. in the last week, with most offers now ranging from $44.00 cwt. to $45.00 cwt. ($970/mt to $992/mt or $880/nt to $900/nt) ex-Midwest mills. However, as a result of the new coating extras and low domestic production volume of light gauge HDG, spot offers for 0.012" x 40.875" G30 (0.30 mm x 1.04 m) are up a steeper $2.00 cwt. ($44/mt or $40/nt) in the past week (and up as much as $4.00 cwt. in the last two weeks), with most offers now ranging from $46.00 cwt. to $48.00 cwt. ($1,104/mt to $1,058/mt or $920/nt to $960/nt) ex-Midwest mills.

Domestic base prices for Galvalume coils are also up by about $1.00 cwt. since last week with most offers now ranging from $34.00 cwt. to $35.00 cwt. ($750/mt to $772/mt or $680/nt to $700/nt). Offers of Galvalume 0.019" x 41.5625" Gr80/AZ55 are similarly up $1.00 cwt. with most offers now ranging from $43.00 cwt. to $44.00 cwt. ($948/mt to $970/mt or $860/nt to $880/nt) ex-Midwest mills.

Import HDG offers have also been rising along with US domestic prices, with offers from both China and India up by about $1.00 cwt. within the last week. Offers of 0.019" G90 from China, India, and Taiwan currently range from approximately $43.50 cwt. to $45.00 cwt. ($959/mt to $992/mt or $870/nt to $900/nt) duty-paid, FOB loaded truck in US Gulf ports, and Taiwan is expected to raise prices further next week.

For the light gauge HDG item, 0.012" x 40.875" G30 (0.30 mm x 1.04 m), Mexico is mostly out of the market though there are some limited offers heard at $43.00 cwt. to $45.00 cwt. ($948/mt to $992/mt or $860/nt to $900/nt) delivered to the border crossing, which is up $1.00 cwt. since last week. Indian and Chinese offers of 0.012" G30 are currently at the same range as their offers of 0.019" G90, with most offers ranging from $43.50 cwt. to $45.00 cwt. duty-paid, FOB loaded truck in US Gulf ports.

On the Galvalume side, import offers from Mexico are up about $1.00 cwt. within the last week, with most offers of 0.019 Gr80/AZ55 now ranging from $44.00 cwt. to $46.00 cwt. ($970/mt to $1,014/mt or $880/nt to $920/nt) delivered to the border, while Chinese offers are up a steeper $1.50 cwt. ($33/mt or $30/nt), with most offers now ranging from $46.50 cwt. to $47.50 cwt. ($1,025/mt to $1,047/mt or $930/nt to $950/nt) duty-paid, FOB loaded truck in US Gulf ports. India is currently out of the market and new offers from Taiwan are expected soon.

Offshore lead times for HDG and Galvalume offers are currently for March/April deliveries.