Last week was an interesting one for the US flat rolled market, with one major producer announcing a price hike for November shipments, and two other mills suspending their acceptance of new orders for October.

The market has yet to see a November price hike from spot market leader Nucor, but following several successive sheet price increases since June, ArcelorMittal USA made the bold move last Wednesday of pushing up spot prices on sheet, effective immediately, by another $60/nt ($66/mt or $3.00 cwt.). This move is the firm's fourth price hike this year, and, as outlined in an internal memo to sales representatives, aims to push hot rolled coil (HRC) spot prices to $30.00 cwt. ($661 /mt or $600 /nt); cold rolled coil (CRC) prices to $35.00 cwt. ($772 /mt or $700 /nt) and hot dip galvanized (HDG) prices to $36.00 cwt. ($794 /mt or $720 /nt). The integrated producer is reportedly full for October orders and the new prices will be effective for November delivery.

Also last week, both mimimill flat rolled producer Nucor Sheet Mill Group and West Coast producer California Steel Industries (CSI) announced they would suspend acceptance of new orders for October. A price hike from these producers, akin to ArcelorMittal's, is expected imminently.

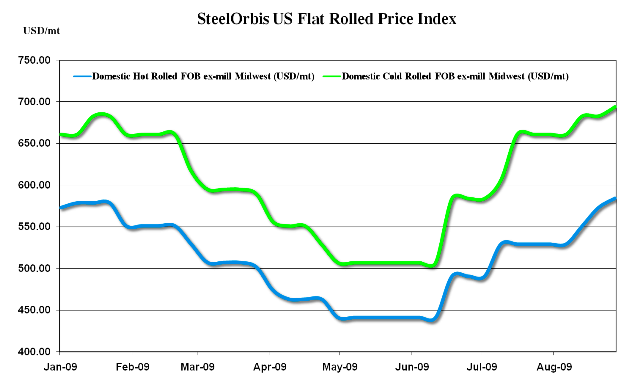

It is still too soon to say where spot prices will ultimately settle in at, but prior to the increase last week, most domestic HRC spot offers for October shipment were found in a range of $26.00 cwt. to $27.00 cwt. ($573 /mt to $595 /mt or $500 /nt to $540 /nt) ex-Midwest mills, while most domestic CRC spot offers were in the range of about $31.00 cwt. to $32.00 cwt. ($683 /mt to $705 /mt or $600 /nt to $640 /nt) ex-Midwest mills.

The latest domestic price increase is a sign of strength for the US flat rolled market as it approaches the end of the year. Nevertheless, there is some concern about whether the market will still be this strong by the end of the fourth quarter. Despite the increasing prices and a slight up-tick in consumption, overall demand is still an estimated 50 percent below normal levels, historically speaking, for this time of year. Although supplies were reduced to bare-bones levels by mid-year, with both prices and production now steadily increasing, the US flat rolled market could potentially be in for another bubble burst in end-Q4 or early next year if demand does not continue to recover.

The latest US service center shipment data show that flat rolled demand was still severely down as of July. The latest Metal Service Center Institute (MSCI) monthly shipment and inventory report indicates that monthly shipments of flat rolled steel from US service centers totaled 1.51 million nt in July, compared to July 2007 and 2008 monthly shipment totals of 2.51 million nt and 2.42 million nt respectively. Nevertheless, inventory levels were at their lowest levels in over two years. The MSCI report shows that July ending inventory decreased further from 3.03 million nt in June to 2.80 million nt in July, while average inventory overhang decreased from 2.1 months in June to 1.8 months in July, its lowest level in over two years.

While demand may have yet to post a full recovery, US mills have the luxury of lack of legitimate import pressure. Traders continue to see virtually no offers for HRC, apart perhaps from some scattered Russian offers, and very limited CRC activity. India, China and Brazil have made some recent offers on CRC but they are priced way beyond the US market range, while Mexico, Venezuela and Argentina are fully booked and currently not offering to the US. Perhaps the most active offshore source offering CRC to the US is Korea; however, most of their offers are mostly for high-strength steel and other niche products. Most foreign sources' domestic markets remain strong, and US prices have yet to rise to their desired price levels.

Preliminary census data from the US Department of Commerce demonstrate that monthly HRC exports to the US increased for the first time since February, from 75,413 mt in June to 81,421 mt in July; however tonnage was still down significantly from the 218,168 mt of HRC imported by the US in July 2008. The top five exporters of HRC to the US in July 2009 were: Canada, at 41,414 mt; Australia, at 15,178; Mexico, at 8,183 mt; Netherlands, at 6,494 mt; and Japan, at 5,074 mt.

Meanwhile, census data indicates CRC exports to the US decreased for the third consecutive month in July, dropping from 45,204 mt in June to 39,493 mt. The top five CRC exporters to the US in July were: Canada, at 11,094 mt; Japan, at 8,529 mt; Mexico, at 6,235 mt; Brazil, at 4,044 mt; and Korea, at 3,003 mt.

Item | US Domestic Spot Price | From Last Week | From Last Month | Pricing Trend | Comments | |

$26.50 cwt. ($584 /mt) | up $0.50 cwt. ($11 /mt) | up $2.50 cwt. ($55 /mt) | J | ex-mill Midwest | ||

$31.50 cwt. ($695 /mt) | up $0.50 cwt. ($11 /mt) | up $1.50 cwt. ($33 /mt) | J | ex-mill Midwest | ||