Spot ranges in the US domestic coated market have not moved over a week ago, although most bookings are taking place at the peak of current ranges. Most mills are now quoting buyers as high as $48.00 cwt. ($1,058/mt or $960/nt) ex-Midwest mill for hot dipped galvanized (HDG) and Galvalume base as price tendencies move upward, as other mills began informing customers late last week that benchmark prices for both products are now at approximately $50.00 cwt. ($1,102/mt or $1,000/nt).

Although mills had appeared to be ready to pull the trigger and issue a price increase for some time now, it wasn't until February 16th when buyers began reporting to SteelOrbis that asking prices from most producers had reached $50.00 cwt. Mills' sheer inactivity in responding to AK Steel's announcement until just recently may have been what one Southern manufacturer called "mills' opportunity to feel out the market and determine what prices the market will actually accept."

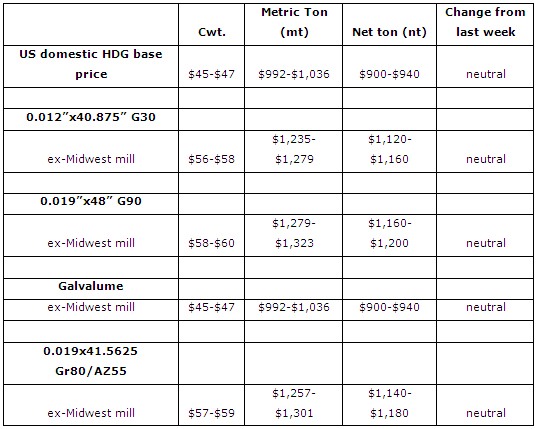

The most commonly reported spot ranges for both HDG and Galvalume base products are still in the range of $45.00-$47.00 cwt. ($992-$1,036/mt or $900-$940/nt) ex-Midwest mill with the lower offers fading quickly. Spot ranges on extras have shown no movement as well, however buyers are reporting difficulty in booking the lower end of the below ranges, despite what appear to be some positive economic signs.

Overall market conditions seem to be improving. Housing starts in the US surged in January, increasing 14.6 percent after falling 4.3 percent in December, and manufacturing output in the metals sector is improving as well according to the Institute of Supply Management (ISM). Still, buyers are wary of the higher prices and are not placing orders today for too far into the future, which has consequently translated to a continued slowing of import activity.

Few import offers are available to US buyers, which is of little concern with the continual decrease in inquiries over the past weeks. Chinese offers on HDG 0.012"x40.875" G30 have settled in the range of $52.00-$54.00 cwt. ($1,146-$1,190/mt or $1,040-$1,080/nt) duty-paid FOB loaded truck in US Gulf ports, $4.00 cwt. ($88/mt or $80/nt) below US prices, but interest is almost non-existent. Mexico, which has been out of the coated market for some time now, does appear to be slowly re-entering, and is expected to mirror US prices and offer Galvalume 0.019x41.5625 Gr80/AZ55 in the coming weeks.

Import HDG offers to the US | Cwt. | Metric ton (mt) | Net ton (nt) | Change from last week |

0.012"x40.875" G30 | ||||

$55-$57 | $1213-$1,257 | $1,100-$1,140 | neutral | |

$52-$54 | $1,146-$1,190 | $1,040-$1,080 | newly offered | |

Galvalume | ||||

0.019x41.5625 Gr80/AZ55 | ||||

$55-$56 | $1,213-$1,235 | $1,100-$1,120 | neutral |

*duty-paid FOB loaded truck in US Gulf ports