After an uptrend in the US domestic flats market stalled last week, spot prices are once again beginning to retreat.

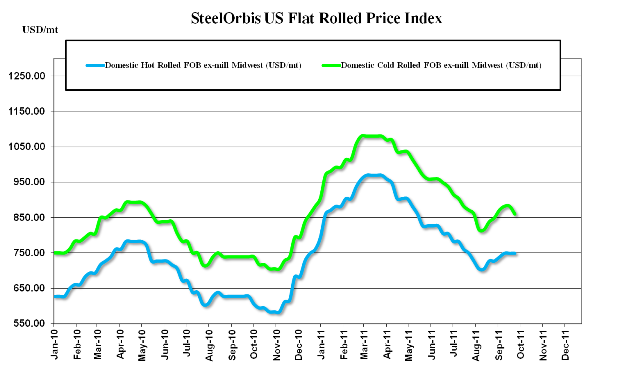

US domestic flats mills' desperation for orders and buyers' reluctance to purchase anything beyond what is immediately needed has resulted in selective price reduction for many large (and even average-sized) orders on hot rolled coil (HRC) and cold rolled coil (CRC). Domestic HRC spot prices are still in the range of $33.00-$35.00 cwt. ($728-$772/mt or $660-$700/nt) ex-Midwest mill, but the bulk of activity is now on the lower end of the range, and one large service center source told SteelOrbis that "$32.00 cwt. ($705/mt or $640/nt) ex-Midwest mill isn't out of the question either." CRC spot prices have already fallen $1.00 cwt. ($22/mt or $20/nt) in the last week and can be found in the range of $38.00-$40.00 cwt. ($838-$882/mt or $760-$880/nt) ex-Midwest mill.

Since domestic mills have not been willing to cut production levels for risk of losing their market share, they are employing other techniques in order to try and curb some of the current oversupply that is keeping HRC lead times at about two weeks, and even shorter from some mills. One such tactic has been advancing maintenance outages that had been planned for later this year. At least two major mills are in the midst of approximately one-month-long maintenances, with shorter outages evident from a number of other producers. Additionally, because US domestic HRC prices are some of the lowest in the world, some mills have shifted some of their focus on the export market, particularly for HRC. But even so, domestic flat-rolled availability is so profuse that the maintenance breaks and increased exports won't be enough to stop another decline in flat-rolled spot prices.

As for imports, while there are a few foreign offers available, they are being mostly ignored by most in the US market as being too uncompetitive to even give a second thought--a sentiment that will continue unless the US spot prices firm, or import prices drop considerably. Regardless, Russian mills are offering HRC to the US in the range of $36.00-$37.00 cwt. ($794-$816/mt or $720-$740/nt) DDP loaded truck in US Gulf ports--$2.00-$3.00 cwt. ($44-$66/mt or $40-$60/nt) above US domestic spot prices. Chinese CRC offers are also still available in the range of $42.00-$43.00 cwt. ($926-$948/mt or $840-$860/nt) DDP loaded truck in US Gulf ports--reflecting yet another week of stagnant prices.