Stainless consumption in Turkey has been on a rising trend for one month now thanks to the revival in white goods, automotive, kitchen equipment and shipbuilding, and this situation has been reflected in price levels. Thus, nickel prices have increased to a range of $14,500-15,500/mt from its previous level of $12,000/mt. The price of 304/2B grade 2 mm stainless steel coil has reached €2,100-2,300/mt. However, the main reason for this uptrend in prices is not so much the surge in demand as the lack of sufficient supplies to satisfy the rise in demand, which has been within normal levels, and also cost pressure.

The stainless sector in Turkey is strongly dependent on foreign producers as the market is in general an importer. At present, the important producers in Europe can only give September or October shipments for new material orders in most qualities. As a result, firms with emergency needs have turned their attention to the local market, where prices have registered a rapid uptrend as stocks have not been at high levels. However, some slowness has been observed in the last two weeks in the local Turkish market.

As the main reason behind the abovementioned slowness, leading sectors such as automotive (which had been registering a recovery in both local and export markets until early this month) have registered a slowdown. As is well known, Europe constitutes an important share of the Turkish automotive export market and a certain tightness of steel demand is currently observed as Europe gets ready to go on holidays in August. In addition, the automotive producing factories in Turkey generally halt operations for two weeks in August.

The white goods sector in Turkey can be described as quite active in the current period, and this surely has a positive knock-on effect on the stainless sector. Additionally, it is observed that the supply problem is greater as regards the qualities of material used in white goods.

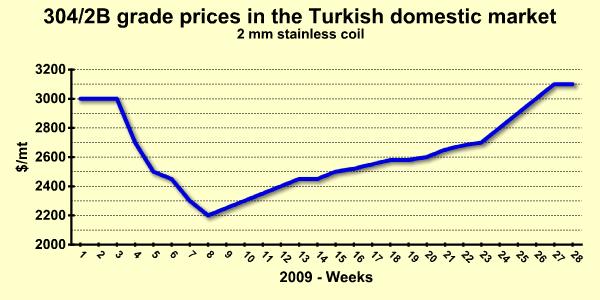

As is widely known, the stainless steel sector is one of the sectors which has been most affected by the global crisis. In crisis periods, luxury consumption is normally hit the hardest and, as a result, stainless consumption typically registers a strong downtrend at such times. Price levels of 304/2B grade 2 mm stainless coils on a weekly basis in the local Turkish market from the beginning of 2009 are presented in the following graph.

As seen in the graph, the stainless sector in Turkey hit its lowest point of the global crisis in the eighth week of the year, and prices have been moving on an uptrend since then, increasing roughly to the same figures as at the beginning of 2009. However, it is not certain how long this rising price trend will last. With production at such low levels currently, possible strong demand could cause stainless prices to increase sharply after the holidays. It should be remembered that the days when nickel prices were at $55,000/mt are not so far away. Although those levels will hardly be seen again, it is certain that, if any uptrend in demand occurs, prices will likely register a sharp increase until such time as supplies start to meet the increased demand. For this reason, it is important to monitor the producers' production capacities in order to anticipate the future levels of prices. Additionally, prices appear unlikely to decrease given current demand levels.