Demand in the Turkish hot rolled coil (HRC) market has remained slow in the past week, while prices have not changed. Market sources state that the quiet activity is normal due to Ramadan and that they expect demand to improve in the post-Ramadan period, especially as prices have not softened despite the stagnant activity. Meanwhile, tight availability of hot rolled pickled and oiled coil still exists.

Domestic producers are also receiving poor demand for HRC, while their prices have remained unchanged. Last week, Chinese producers started to restock iron ore and so ore prices have increased, while scrap prices have remained firm. Since producers' raw material costs have increased, no decrease in their HRC prices is expected.

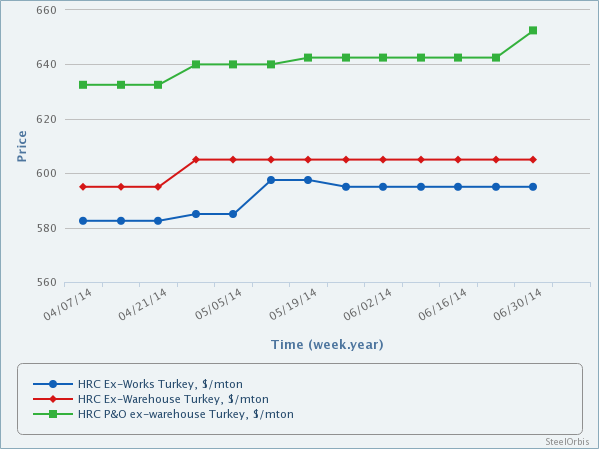

Producers' HRC prices are at $590-600/mt, while $5-10/mt discounts are available to certain buyers and depending on tonnages.

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 600-610 | 605-615 |

2-12 mm HRC (for large volume sales) | 590-600 | |

1.5 mm HRS | 630-640 | 635-645 |

3-12 mm HR P&O | 645-650 | 655-660 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.